After climbing for four consecutive quarters, Gold prices reached a new all-time high in October 2024, peaking at US$2,790/oz. However, the momentum faltered in Q4, with Gold giving back all its quarterly gains to close the quarter marginally lower by US$9.79/oz, or 0.37%. As we transition into Q1 2025, our proprietary system signals a shift in market dynamics, with Gold bears attempting to wrest control from the bulls. This suggests a potential further pullback in prices during the quarter. Bears are eyeing the US$2,537/oz level—the low from Q4 2024—as a key test of demand strength. However, this pullback is expected to be brief and temporary, as the long-term cyclical uptrend for Gold remains intact.

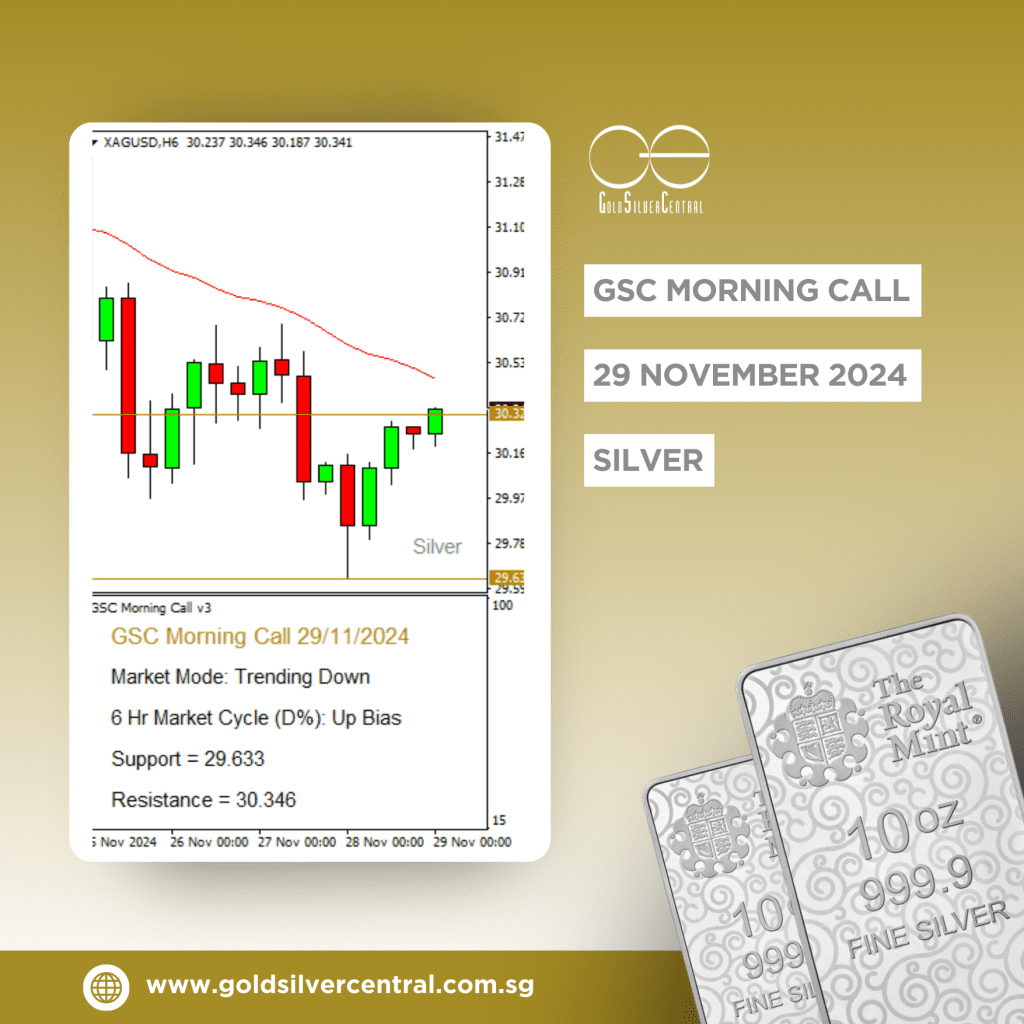

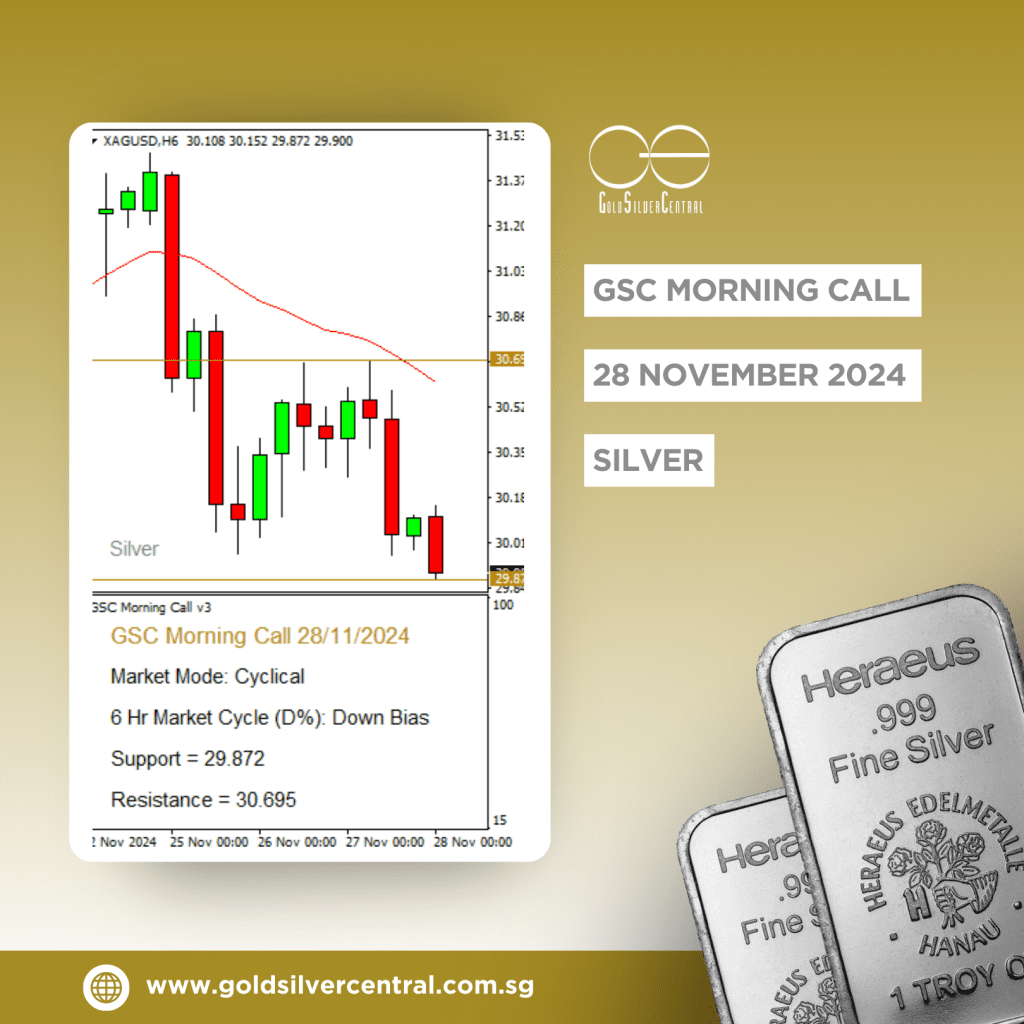

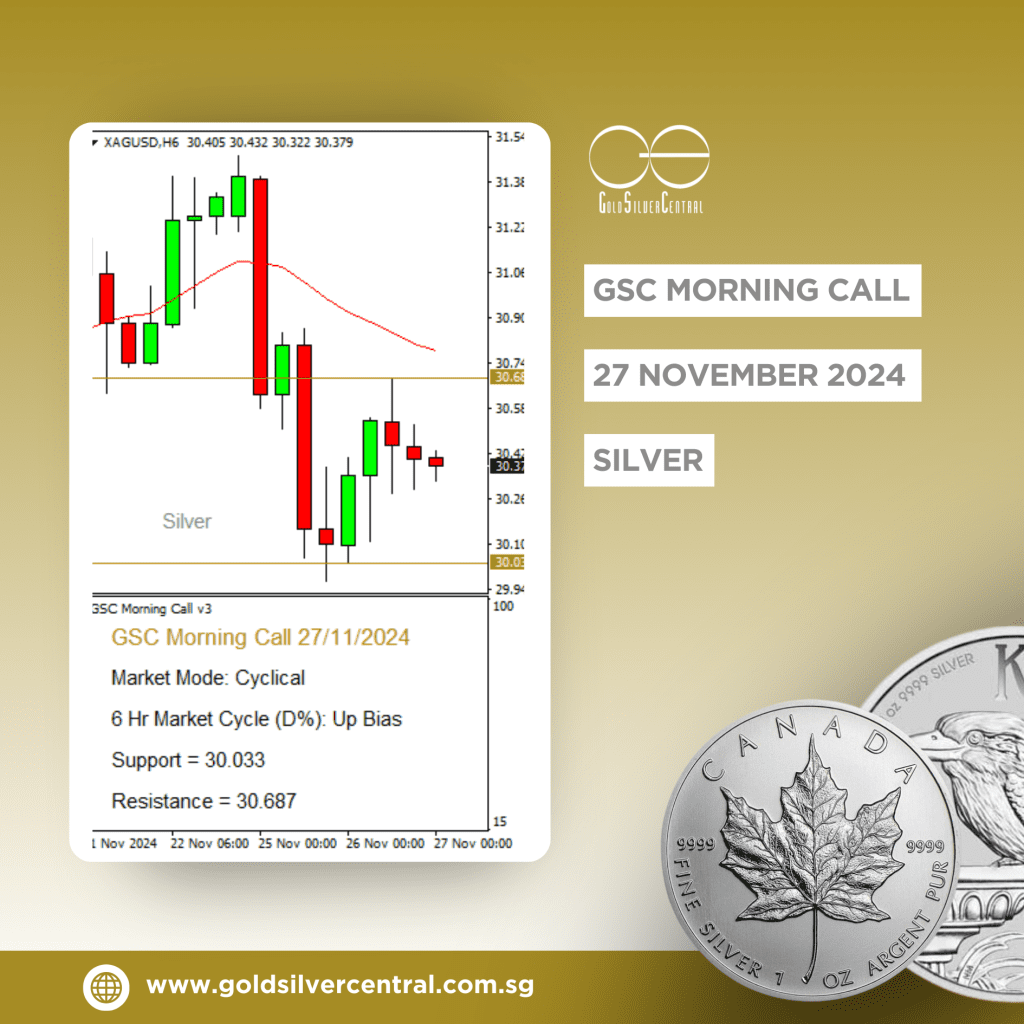

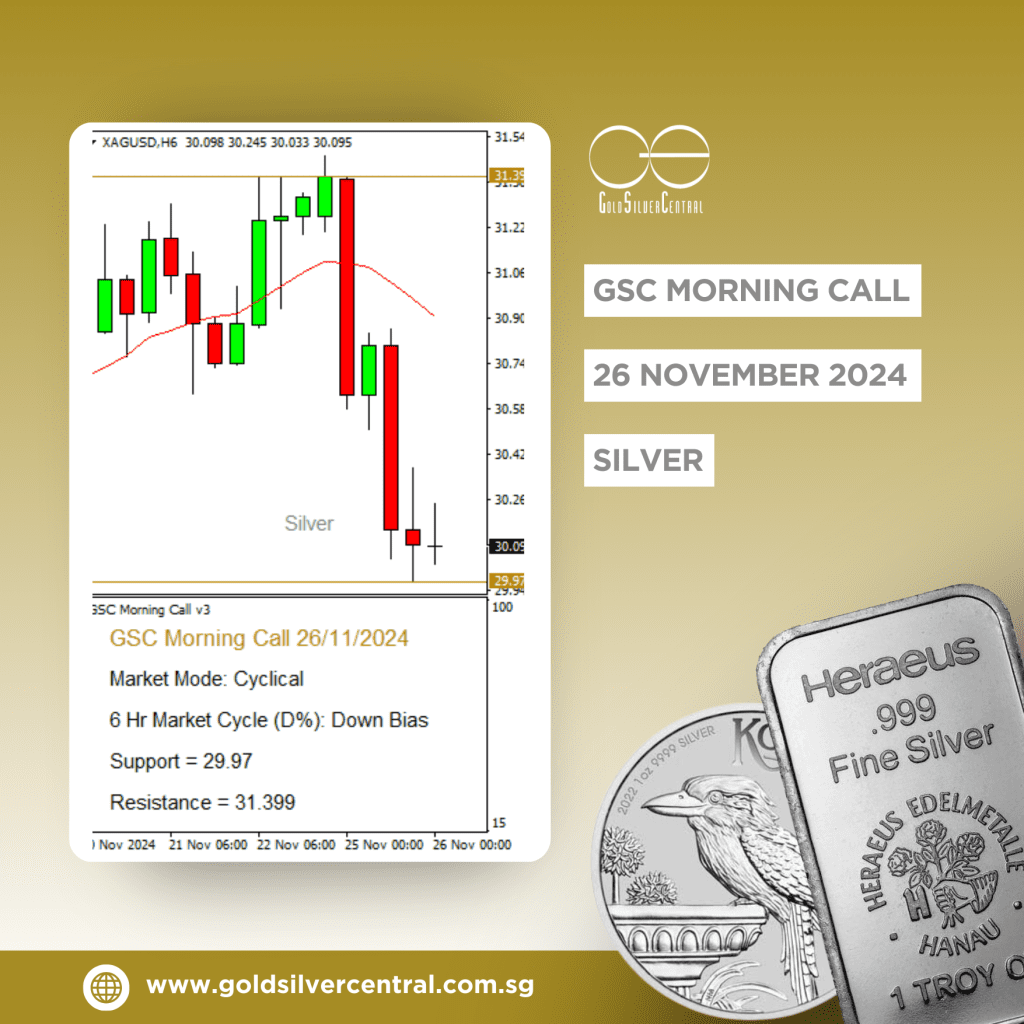

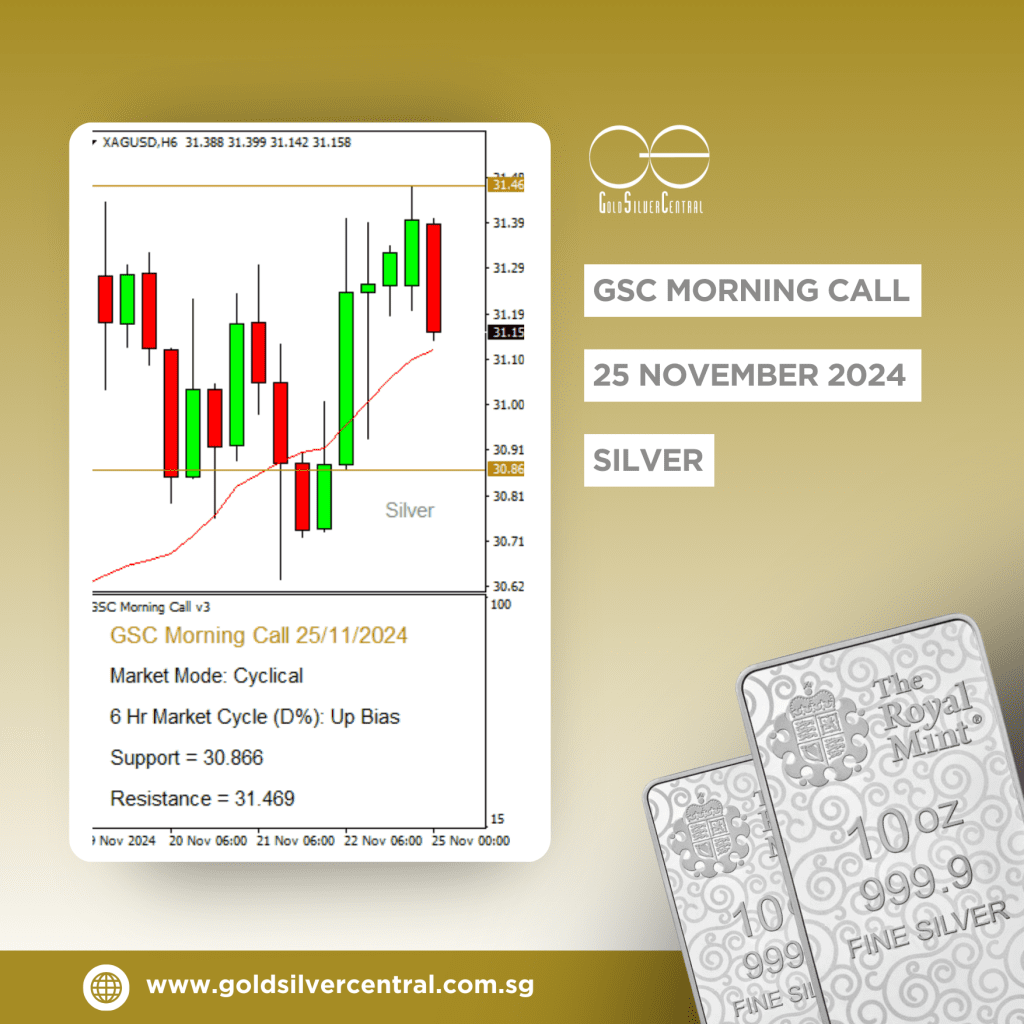

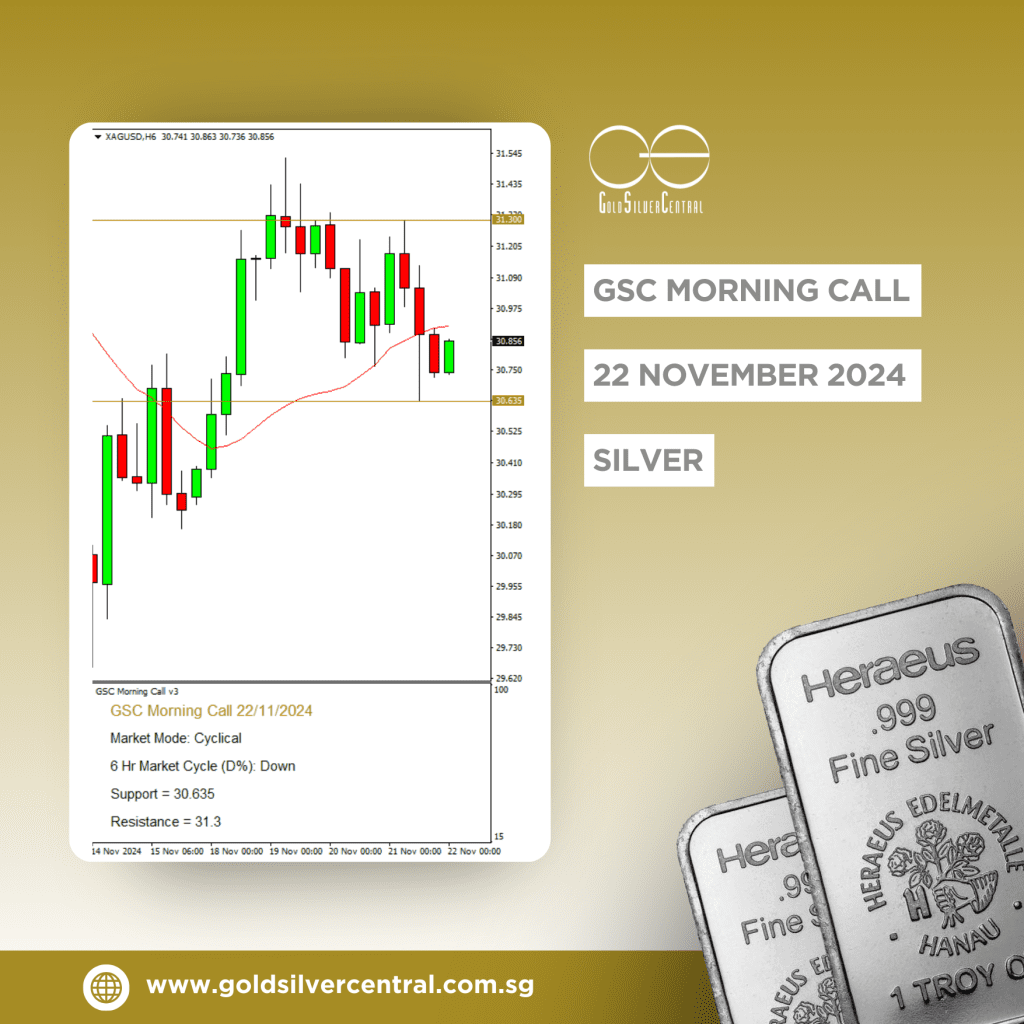

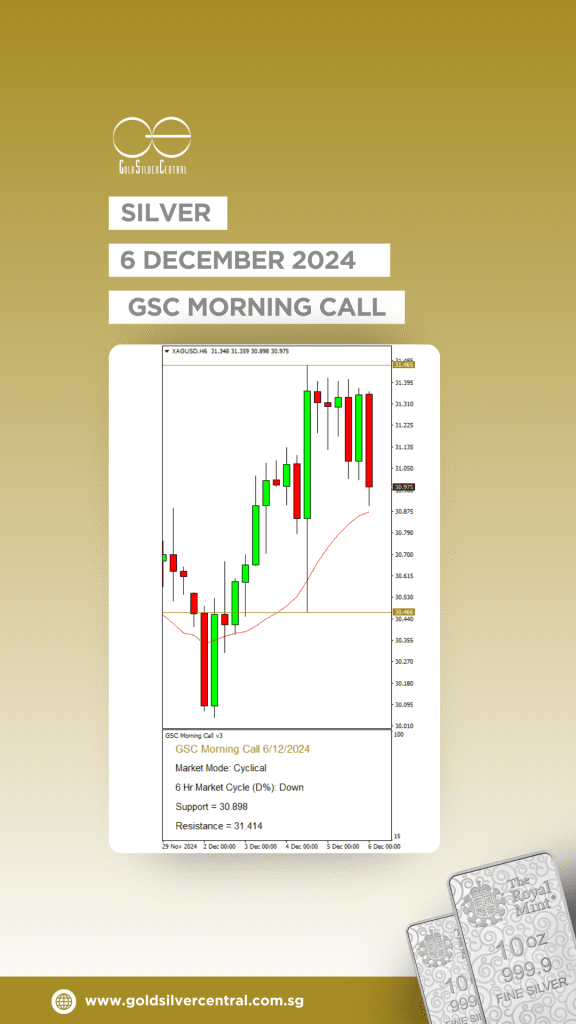

Similarly, Silver prices saw a marked decline in Q4, dropping 7.21%, or US$2.24/oz, after four consecutive quarterly increases. Looking ahead to Q1 2025, our analysis indicates further pressure on Silver, with bears targeting the US$26.45/oz level, which represents the low from H2 2024. While early signs suggest the current bull trend for Silver may be stalling, there is no definitive evidence of a shift to a bear market yet.

Our system suggests that if the broader precious metals market continues its downtrend, Silver’s downside risk may surpass Gold’s in percentage terms this quarter.

Platinum prices also retreated in Q4, declining by US$78.36/oz, or 7.99%. Despite this, Platinum has stayed within its well-established trading range of US$850/oz to US$1,100/oz, a band that has persisted since Q3 2021. As we enter Q1 2025, our system forecasts continued range-bound trading for Platinum, albeit with a downside bias. Bears are likely to test the US$850/oz level, the lower boundary of this range.

For additional insights or inquiries regarding our Q1 2025 outlook for the precious metals market, please don’t hesitate to reach out. We are always here to support you and wish you a successful trading quarter!

![[916] GSC graphic (4)](https://www.goldsilvercentral.com.sg/wp-content/uploads/2024/12/916-GSC-graphic-4-460x260.png?x58451)

![[916] GSC graphic (3)](https://www.goldsilvercentral.com.sg/wp-content/uploads/2024/12/916-GSC-graphic-3-460x260.png?x58451)

![2[1]](https://www.goldsilvercentral.com.sg/wp-content/uploads/2024/12/21-460x260.png?x58451)