1. Algorithmic traders derived similar sell levels and multiple stop loss or stop out levels were triggered

Many algorithmic traders might have derived similar sell levels based on their technical models and there might have been hundreds or thousands of sell orders once prices hit their sell limit levels. This dip happened during the early hours of Singapore time, also during the wee hours in Europe and late night in the US. Those who had long positions might have had their positions automatically liquidated due to insufficient margins and as prices go lower, this would be further exacerbated into a downward spiral.

Coincidentally, this price dip happened on public holidays in Singapore and Japan. Singapore was celebrating its National Day and Japan was having a holiday in lieu of its Mountain Holiday. There was more trading activity on Friday the week before as US released better-than-expected non-farm payroll figures. This led many to believe that economic recovery was on the way. This probably led to more traders in Asia to leave sell orders before the market opened on Monday.

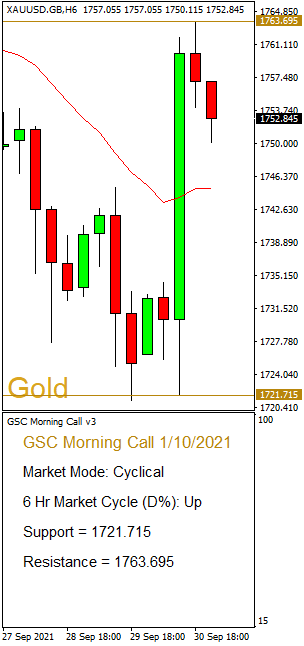

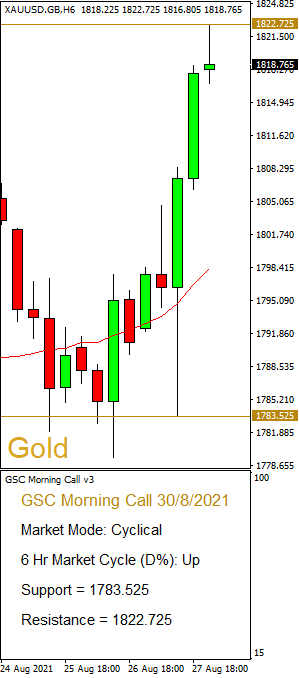

There are a number of gold desks in banks located in Singapore and Japan. Due to the holiday, there were probably fewer traders physically on desk or less experienced ones left on desk to handle the trades. Also, expectedly more trades were on the sell side when market opened, coupled with a lack of liquidity in the early hours with fewer market makers during Asia hours, which resulted in a 4.2% dip in the gold price before finding a support level. Gold prices then recovered very quickly within two hours and prices recovered from the low at US$1,680 to US$1,720 (Figure 1).

Figure 1: Gold Price Daily Chart

Figure 2 and table 1 show increased activities (volume and open interest) on these two particular days as compared to other trading days, but they are nothing out of the ordinary. It is also very unlikely there was “manipulation” as many unhappy investors claimed. There were many market participants that contributed to this dip, as opposed to a single big trade by a market player.

Figure 2: Gold futures – Volume and open interest

The annual seasonal weakness for gold happens during the summer months, which many call the summer doldrums. During this period many family offices, fund managers and traders are on vacation, which means fewer trades executed and hence lesser volatility or price action during this period. Refineries use this period to retool and collect gold dust in their facility as physical demand tends to be lower. As we know, when markets are trading in narrow ranges, not much activity happens and more often than not, investors who are looking for prices to appreciate to make a profit will then lose interest and look at other asset classes to generate their alpha.

Capital will always flow to asset classes that can generate higher returns. This year equity and cryptocurrencies have done well. The S&P has posted 50 new highs this year and a return of about 20% so far. Cryptocurrencies such as bitcoin and ethereum have also done well, with more than 100% returns at their highs. Short-term gold investors were disenchanted as they were expecting gold to hit new highs from what they have seen last year, but prices went persistently lower than the market open on 2 January this year. This probably played a big part in the sell orders we’ve seen, especially when prices fell.

Table 1: Gold futures – Volume and open interest

It seems like gold will do well during the last quarter, hence I remain bullish on the precious metal. There are three main reasons why I believe gold prices will be supported. First, weak hands have been cleared out by this dip and prices can climb from here. Second, central banks that were not usual buyers have been buying gold in big quantities. For example, Brazil bought 62.3 tonnes, Hungary bought 63 tonnes, Japan bought 80.8 tonnes and Thailand bought 90.2 tonnes this year. Prices they bought into were in the range of US$1,780 to US$1,840, hence we might expect to see more central banks buying into gold at current levels, which would be a good support for gold. Finally, jewellery buying from China and India has picked up sharply compared to last year and as we move into the wedding seasons for both countries, we expect demand to pick up during the last quarter. Coupled with the October Comex Gold roll that will be rolled over to December, we could see an exciting end for gold in 2021.

In Crucible 17, I shared that the premiums for 100 oz. silver bars shot up by 687% in February, exacerbated by the silver squeeze. Currently, supply has more or less caught up with demand and we have seen the easing of premiums, though it is still elevated at 250%. However, ready inventory supply is still not at pre-Covid levels, hence we expect premiums to rise if there is a sharp increase in physical demand.

Brian

What is bid/ask spread?

The bid/ask spread is the difference between the price quoted by bullion dealers (Ask price) selling certain Precious Metals and the price that investors are willing to pay for the Precious Metals (Bid price).

For example, for Gold, if the bid price is US$1788 and the ask price is US$1790, the spread will be US$2.

What are determining factors for the spread size?

- Trading volume: The higher the liquidity of the Precious Metals, the higher the trading volume. Precious Metals that are highly liquid will have narrower spreads as many dealers or investors are looking to buy(ask) or sell(bid) with the best price. Precious Metals such as Rhodium have a wider spread as they are less liquid and more volatile when compared to Precious Metals such as Gold or Silver.

- Volatility: Prices may fluctuate when volatility in the Market is high. The bid/ask spread is usually widened for bullion dealers or market makers to manage market risks. For example, when compared to Gold and Silver, Platinum has a wider spread as it is more volatile.

How it affects you as an Investor?

As an investor, you would want to execute a buy or sell order closest to the Spot price. With a narrower bid/ask spread, you can get the best price with the market order itself.

However, a wider bid/ask spread will impose an indirect cost in trading, especially for huge orders. A wider spread will equate to a higher premium for investors. To minimize trading risks, placing a limit order will therefore be a better option. GSC Live! allows you to place a limit order at your desired price with narrower spreads at anytime, anywhere!

Read more about GSC Live!

If you have any questions, feel free to contact us at [email protected] or +65 6222 9703.

Evon

人各有所求,有些人的胃口小有些则反之。 尤其是当我们谈到借贷和现金流,金额的差距可能从100新元到10万新元;期限从1个月到1年以上不等。你会不会 好奇我们都遇到过什么样的例子呢?让我们来分享两则来自Cayden和Diana的故事(人物名字纯属虚构)。

Cayden的父母一直都有投资贵金属的习惯并会带他一起到GSC。从这里他得知了GSC贷款计划。有一天他急需100新元来购买送给女朋友的礼物,可是距离下一个领零用钱的日子还有10天。作为一个18岁没有副信用卡的学生党,他决定把每年生日父母送他的银币抵押来换取现钱。他的银币其实价值400新元可是他只借贷了所需的100新元而已。当他领到零有钱后, 他立刻来偿还了1. 50新元的利息和100新元的贷款以赎回他的银币。整个过程快捷、方便并且负担得起,他无需伸手向父母要钱或向朋友借钱。

另一边46岁的Diana有着很不一样的背景,她经营着从印度入口多种商品的生意。在等着她的顾客在两星期内汇款时,她先需要一个短期且及时的10万新元贷款来偿还一批货。她浏览了数个方案,考虑到金额和短暂的期限,她决定在GSC贷款计划抵押2公斤的金条。在她收到顾客转来的资金后,她在一个月内偿还了所借贷款和1%的利息。

想知道Cayden和Diana是如何做到的?欢迎您浏览我们的网站和阅读金银中央的抵押贷款计划的相关文章。如有任何问题,欢迎您想我们咨询。或在此留下你的名字与联络号码,我们会在一个工作日内联络你。

免责声明: 这些是我们满意的客户对于抵押计划如何帮助他们实现目标的分享,但这绝不是为次作代言或投资建议,可能不适用于所有情况或您的个人情况。 此处共享的信息具有一般性质,不应被视为任何特定问题的专业和/或法律建议。

Maya

Different people have different needs; some might have a small appetite, while others might be the direct opposite. Especially when it comes to getting loans and cash flow management, the amount can vary from S$100 to S$100,000; tenures can range from one month to 1 year or even longer. Curious about what we have encountered before? Allow us to share how we worked out a solution for our clients, Cayden and Diana (Fictitious names created for privacy).

Cayden’s parents have been investing in precious metals for some time and will bring him along during their visits to GSC. He learnt about the GSC Collateral Loan program from one such visit. On one occasion, he needed S$100 urgently to buy his girlfriend a gift on her birthday but he can only get his pocket money 10 days later. As an 18 years old student without a supplementary credit card, he decided to bring the silver coins he received yearly from his parents as a birthday gift to pledge for instant cash. The Silver coins he owned could actually get S$400 loan but he only took the amount he needed, which is S$100. After he got his pocket money, he came to pay the interest of S$1.50 and the loan amount S$100 for redeeming his silver coins. It’s fast, easy and affordable; all done without the need to trouble others including his parents.

On the other hand, 46 years old Diana has a very different profile. She’s running her own business importing various goods from India. To pay off a batch of imported goods worth S$100,000 before incoming funds from her client is received in 2 weeks, she needs a one-month short term loan and needs to get funds fast. She browsed through the available options, keeping in mind the amount she needed and the short loan tenure; she decided to pledge her 2kg Gold bars with GSC under the Collateral Loan program. After she gets the funds cleared from her client, she pays back the loan amount plus 1% interest within one month.

Want to know how Cayden and Diana did it? Feel free to browse our website and articles on our GSC Collateral Loan program. Don’t be shy, go ahead and contact us if you have further queries and our friendly sales team will be more than happy to assist. Alternatively, you can click here to leave your name and contact number and we will get back to you within one business day.

Disclaimer: These are sharing from our happy clients on how the collateral program assisted them to achieve their goals, but this is by no means an endorsement or investment advice and may not apply to every situation or to your own personal circumstances. Information shared here are of general nature and should not be regarded as a substitute for seeking professional and/or legal advice on any specific issues.

Maya

每一个人都会有想追求的东西。可是我们手上的资金是有限的,或是我们也可能因为不符合申请条件而无法拥有信用卡。在这种情况下我们该如何才能得到我们想要的东西呢?让我们来分享两则来自Amanda和Ben的故事 (人物名字纯属虚构)。

一个月前,Amanda刚从大学毕业和开始工作,她目前还不能申请信用卡。可不巧的是她的手机在这个时候坏了,所以她想买一架新的iPhone 12。在有限的条件内,她想到了金银中央的抵押贷款计划。

在她21岁生日时,她的父母和亲戚送了她一些金首饰,这些年也只是存放在她的抽屉里。虽然她本身并不喜欢穿戴金首饰,但因为这些首饰具有特殊意义和保值率,所以她一直保存至今。

现在为了能够在不寻求父母的帮助下也能负担得起一架iPhone12,她决定把这些金首饰作抵押并加上一些积蓄来购买新手机。之后在接下来的6个月拨出每月工资的一小部分来慢慢偿还贷款和利息以赎回她的首饰。

另一边的Ben已经工作数年且刚刚结婚。为了增加他的财富以及为未来计划(例如生小孩与购买房子)作储蓄,他打算投资时下很热门的加密货币。经过他的细心研究,他认为加密货币有增长潜能而现在还是投资的好时机。为了凑足资金做投资,他把结婚时收到的一些不适合平日穿戴的金首饰作抵押以换取现金。

他选择不卖掉这些金首饰是因为他相信黄金是一项资产,保留黄金并拥有多元化的投资组合有利与他。通过抵押黄金,他得到更多的资金来投资其他资产并同时保留黄金的拥有权,可说是一箭双雕。他以投资加密货币所赚到的利润来偿还利息并定时偿还部分贷款以减少利息的金额。

想知道Amanda和Ben是如何做到的?欢迎您浏览我们的网站和阅读金银中央的抵押贷款计划的相关文章。如有任何问题,欢迎您想我们咨询。

免责声明: 这些是我们满意的客户对于抵押计划如何帮助他们实现目标的分享,但这绝不是为次作代言或投资建议,可能不适用于所有情况或您的个人情况。 此处共享的信息具有一般性质,不应被视为任何特定问题的专业和/或法律建议。

Maya

Nevertheless, we all have things we want to pursue in our lives, yet our cash flow on hand is limited, or we might not fulfil a certain requirement to have a credit card. So how can we achieve what we want in this case? Let’s share how we provided a solution for our clients, Amanda and Ben (Fictitious names created for privacy).

Amanda just graduated and started to work a month ago; she is not eligible to apply for a credit card yet. Unfortunately her phone is faulty and she’s looking to replace it with an iPhone 12. With the above mentioned limitations, GSC Collateral Loan might be a program she can consider for the short term.

She has some gold jewellery that she received from her parents and relatives during her 21st birthday celebration, left idle in her drawer. She doesn’t like to wear them but still view them as meaningful and valuable, hence she still intends to keep it.

And now for her to afford an iPhone 12 without asking help from her parents, she decides to pledge the gold jewellery, top up with some of her savings to purchase the iPhone 12 and then repay the loan and interest to redeem the gold jewellery within the loan tenure, which is 6 months after she starts on her new job.

On the other hand, Ben has been working for a few years and just got married. To increase his wealth and save up for future expenses i.e. having a baby and pay for a new house, he’s looking to invest in the recent bullish asset, cryptocurrencies. He has done his research and believe that it’s still a good time to buy into cryptocurrencies now as it still has potential for more growth. To raise enough funds to invest in crypto, he pledged the gold jewellery they received during their wedding since it’s not suitable for daily wear.

The reason for not selling the jewellery was, he believes keeping Gold as an asset is a good diversification in his portfolio and Gold looks like it has further upside. By pledging his Gold jewellery, he gets to unlock the cash flow from an idle asset to invest in other assets classes and yet retain the ownership of Gold. This way he can kill two birds with one stone. He pays the loan interest from the profit he makes in trading cryptocurrencies and from time to time, he makes some repayment to reduce the loan amount and hence the interest that he needs to pay.

Want to know how Amanda and Ben do it? Feel free to browse our website and articles on sharing about our GSC Collateral Loan program. Don’t be shy to contact us if you have further queries and our friendly sales team will be more than happy to assist.

Disclaimer: These are sharing from our happy clients on how the collateral program assisted them to achieve their goals, but this is by no means an endorsement or investment advice and may not apply to every situation or to your own personal circumstances. Information shared here are of general nature and should not be regarded as a substitute for seeking professional and/or legal advice on any specific issues.

Maya

Last week, as part of our Storage month highlights, we looked at one single important reason on why you should own a Storage Account.

Today, we shall look at GoldSilver Central Storage program fees and understand what you are paying for as a Storage Customer.

GoldSilver Central’s Bullion Storage Program has been around since 2012 and has continued to serve our clients well. Located at Changi Le Freeport, a tax-free zone in Singapore, it is now considered amongst the safest area in Singapore.

Below is our Storage Fees Structure:

A question you might have is, what exactly are you paying for?

- Security and Insurance

We know we’ve been saying that your holdings are stored in a secured facility. How secure is it exactly then? For starters, the physical compound is surrounded by concrete walls between steel plates and there are CCTV systems in place. The building facility is maintained by a central Freeport Authority and each vault operator within Changi Le Freeport has their own security system according to their design specs.

What this means is that in order to access your holdings, we would have to go past at least two levels of independent checks. GoldSilver Central also ensure that we work together with LBMA vault operators which adds another level of checks to our clients’ holdings. This also means that vault operators are able to fully insure your holdings due to the high level of security and stringent procedures.

This is the key difference compared to storing your holdings at a location such as your home safe.

No doubt, your home safe would be more easily accessible compared to GSC’s vault storage. However, we do need to consider what happens after you physically access your holdings? (You would still have to find a bullion dealer to sell it to you.)

Which brings us to our next point

Administrative and Convenience costs

GoldSilver Central Storage Clients have the option of being able to sell their holdings anytime they wish to. This can be achieved via our “DIY mobile platform”, GSC Live!. Storage clients have the option of being able to set sell limits or sell outright via GSC Live! and the fund proceeds can be transferred to your bank account after.

Good news is, there’s no need for you to fly into Singapore to transact or to reach an actual human staff at GSC to sell your holdings (You can sell it whenever you wish to.)

Also, if you are already storing your holdings at an external deposit box or a secured warehouse, we would like to propose you consider GSC Storage program as well. Ultimately, wherever you are storing your holdings, I would personally look at it as a potential investment in a partner (if you store it at home, then your partner is yourself!) that could assist you in your precious metals investment. And GoldSilver Central can help you to decrease your risks.

Perhaps a good question to guide you in your considerations would be:

Will the benefits of having a GSC Storage account offset the low costs?

At the end of the day, a wise man once said:

“Price is what you pay, value is what you get.”

If after reading this article, if you wish to speak with GoldSilver Central to see exactly how we fit into your financial planning, let us know. We are honored to be part of your precious metals journey.

Jason

GoldSilver Central’s Bullion Storage Program created since 2012 has continued to serve our clients very well. Located at Changi Le Freeport, a tax-free zone in Singapore, it is now considered amongst the safest area in Singapore.

Today, as part of our Storage month highlights, we shall highlight one important reason to have a Storage Account

Better manage your risks.

We know that proper management of risks is important in building your wealth portfolio.

Major unforeseen events like Covid-19 should give us a renewed respect for unpredictable catastrophic events and its possible impacts on our portfolio. For instance, a client who lives in Malaysia declines to store his precious metals in Singapore and instead stores it at his home safe, as he can cross over to Singapore very quickly if he ever needs to sell his holdings. Covid-19 hits and suddenly countries are on lockdown and borders are closed. Good luck trying to travel across to sell your precious metals. That is not going to happen.

Also consider a situation where a black swan event occurs and silver prices are skyrocketing, the market is going into a frenzy, and you are keen to bring your silver holdings into a bullion dealer for a valuation and sellback. Chances are the majority of the market will be looking to do the same thing and you suddenly find yourself jostling amongst others and trying to sell your silver at the highest possible price before the prices drop. Again, throw in Covid-19 into the above situation when many countries went into lockdown, and you could not even travel outside your home for non-essential purposes. (I may be wrong, but I highly doubt “I have to sell my silver before prices drop again” will pass as an essential purpose in the eyes of the law.)

During these times, you can clearly see the benefits that having your precious metals holdings stored with a trustworthy and reputable dealer like GoldSilver Central. For your reference, no storage customers of GoldSilver Central faced any issues in their transactions with us even as they are unable to travel due to Covid19 restrictions.

GoldSilver Central has built up an intensive network of trusted and international partners over the years. By building up such an extensive network, we can ensure constant liquidity, regardless of market conditions. Also, we are better positioned to negotiate with refineries and to buy / sell excess in the market compared to an individual investor looking for a single sell transaction. May I take this chance to also add that we have our GSC Live! Platform where clients can lock in their buy/sell prices on their physical precious metals on their own mobiles, instead of having to try calling in to GSC together with the hordes of people who probably have the same intention to try and sell their precious metals then.

That’s it for today, we’ve explored one of the reasons of having a Storage Account with GoldSilver Central. In our next article special, we’ll dive deeper into the fees of the Storage Account. Till then, stay safe!

(If I may just add a personal plug, for investors interested to understand more about “black swan events”, read <<The Black Swan by Nassim Taleb>>)

Jason

English Version: Why are your Spot prices different from other bullion dealers or platforms?

“为什么你的现货价格与其他贵金属交易商或平台不一样?”。这是我们在门市常遇见的问题。所以今天我们就来大约讲解这个问题。

- 价格取决于网站的更新速度。

贵金属的价格是以毫秒为单位来更新的。可是网站却无法负荷如此频密的更新速度,而每秒更新的速度也会致使整个网站瘫痪。因此,网站的更新速度通常没有那么频密,甚至可能在几分钟后才更新。金银中央网站的价格是每两分钟更新一次。

- 所有的贵金属交易商或平台都有不同的流动性提供者或价钱来源。

流动性提供者会以最小的差价提供价格给各贵金属交易商或平台。不同的流动性提供者所提供的价格未必相同。因此,每个贵金属交易商的现货价格都会不一样。更何况现货价格在国际上是以美元为单位来交易,这必须转换成当地的货币单位例如在我们的情况下就是新元。这汇率换算也会造成一些差价,差价大小取决于贵金属交易商所使用的外汇流动性提供者所提供的汇率。在大多数情况下外汇流动性的提供者会是银行,而银行会从兑换率的差价中赚取利润。这样层层堆叠上去就会扩大本地货币(新元)的现货价格。

不同的因素如市场需求、市场情绪、买卖商数量等都会影响或决定现货价格。即使是一样的贵金属(金银条,硬币),在不同的国家以及不同交易商所在的地区也会影响它的售卖价格。我们将在以后的文章进一步讨论这些课题。如果你有什么疑问,欢迎你向我们咨询更多详情!防疫期间,注意安全!

Evonne

中文翻译: 为什么你的现货价格与其他贵金属交易商或平台不一样?

“Why are your Spot prices on your website different from other bullion dealers or platforms?”. This is a question that we often hear from our retail clients. So, today we will be answering this question briefly.

- The prices are dependent on the frequency of price updates to the website. Precious Metals’ prices fluctuate every millisecond. However, websites are not able to handle the frequent update of prices and setting it to update every second will crash the site unless a lot of resources is set up just to support this and this in turn will be very costly. Thus, the refresh rates for websites are usually less frequent and it might only be updated only after a few minutes. Prices on GSC website are updated every 2 minutes.

- All bullion dealers or platforms have different liquidity providers or price source. Different liquidity providers will provide different prices with minimal spread. Thus, the Spot prices would not be exactly the same for different dealers. Moreover, spot prices in different currencies (depending on home currencies of dealers) for example in our case SGD, will also need to be converted from USD to SGD as Gold is traded in USD predominantly. This would also incur some spread and depending on the forex liquidity provider that the dealer uses for currency exchange, in most cases banks, there will be a spread as the bank will have to make their margins. This will widen the spot prices quoted in the local currency, in our case SGD.

Spot prices can be affected or determined by various factors such as market demands, sentiments, number of buyers and sellers and more. Even location of the dealer and thus the cost of bullion can differ for the same bar or coin in different countries. We will further discuss these in future articles. If you have any questions, please feel free to contact us to understand more! In the meantime, stay safe!

Evonne