2020 was the banner year for Gold, hitting US$2074.96/ounce in August 2020. Silver has hit its high since April 2011 at US$29.795/ounce and Platinum has hit US$1075.699/ounce since August 2016.

Based on the GSC 10 a.m. Reference Price, Gold has increased 24.93%, Platinum has increased 47.44% and Silver has increased 47.54% in 2020.

The lowest price for all metals occured in March for the year 2020. This is also the period when the pandemic started to proliferate globally.

The pandemic has accelerated the rally for investors who are looking to protect their wealth, and this led them to stockpile precious metals, the known safe-haven. In addition to the increase in demand, the pandemic has affected the supply chain for the precious metals due to lockdowns. All these led to an increase in the premium of physical stocks.

With the huge government debt, negative real returns on bonds, low or negative interest rates and threats of inflation and market turbulence, what would your precious metals forecast be for 2021?

Will the silver continue to outperform in 2021? Will the basis of positive blast from the green transformation driving increased industrial demand, and the expected economic recovery?

Below is the chart that shows the Gold, Silver and Platinum spot price (SGD & USD) movement line for the year 2020. Based on the charts below, it shows that Gold and Silver are in tandem and have a closer correlation as compared to Platinum hence a diversification across different precious metals might be a good idea for a more robust portfolios.

Price based on GSC 10am Reference Price

Suzane

I believe most have read about the recent Reddit group that has spurred on many other retail investors to short squeeze stocks that hedge funds have big short positions in. The idea is to drive prices of the stock high enough to force the hand of these hedge funds to buy back the stocks they have borrowed to sell, at a loss.

Why didn’t this work with the Silver Market?

The commodities market doesn’t work the same way as the stock market. The shorts reported by CME or Commitment of Traders Report (COTR) does not mean that all of these shorts are speculative positions or positions that traders have placed to bet that prices will go south for them to make a profit. Most of these short future positions are to hedge physical Silver exposure or miners to secure prices in the future to deliver mined Silver against. In other words, these short future positions are being offset with physical bars and coins held in their inventory.

Another point to note, we do not know what is on the trading book of each bank and they might have positions not pushed out to the market yet as they have taken on a big position. For example, the trader in a bank has bought a sizable amount of Silver from a fund and yet to sell it out in order not to move the Silver price too drastically. This ride up in Silver prices allows them to hedge out their risk at a much higher profit and due to the larger number of buyers available, it will also allow them to get out of their positions even earlier and at a tidy profit.

Bottom line is, we do not see the full picture from the reports provided via CME or COTR.

The financial institutions raised margins to prevent Silver prices from soaring, is this true?

Margins were raised by 18% by Comex but this was not because the institutions wanted Silver prices to stay low. Many brokers followed suit. Margins for trades is a function of volatility. The higher the volatility the higher the margins required. This is for risk management and also to protect the interests of investors. This will happen for any asset class not only for Silver. This often has been misconstrued by many to think that the institutions did this on purpose for their own gains.

Physical Silver premiums shot up sharply, does this mean there are not enough physical Silver?

Physical Silver premiums came up at least 30% or more but it does not mean that physical Silver have all ran out. The sudden sharp increase in physical demand from clients globally due to this Silver squeeze coupled with the Covid-19 measures implemented in mints and refineries lead to a short term tightness of physical Silver bars and coins. There are still large Silver bars available in many vaults around the world but they are not the preferred choice for retail investors.

The manpower restrictions due to Covid-19 also meant that production schedules for Silver finished products have to be extended especially with this huge increase in demand. These factors led to the increase in premiums and it will ease once the Silver orders backlog has been met.

Brian

If you are reading this, you are likely interested in Precious Metals. At GoldSilver Central, we take care of your needs. This means we actively find ways to value add to your portfolio. And we’ve discovered that Precious metals investors can be categorized into 2 categories:

- Profit & Loss

- Asset on your Balance Sheet

Let’s analyze this further.

- Profit & Loss Category

To you, gold is like any other investment, you want to achieve capital gains from it in the shortest time frame possible. Of course physical gold has additional physical premiums on top of the market spot price, but if you foresee the demand will exceed supply in the near term and given the increasing rate of uncertainty in the economic market, having exposure to gold, the world’s oldest asset and it being a safe haven, is a no brainer for you. And you will make a quick profit once prices have risen to your desired levels.

So what then?

As we said, we’re here to take care of you! Here are a few ways we can do so.

- GSC Live! (Download here for Free!)

A mobile friendly application that is a powerful tool for investors. You now have the capability to view and transact based on live streaming market prices. Yes, that is right, you are able to buy / sell anytime and anywhere that you find convenient. And the best part? It’s 100% physically deliverable. Yes, let me repeat, 100% physically deliverable. You can exchange the pool allocated gold in your GSC Live! Account for physical bars & coins at our retail shop.

- Retail Services

Surprise! Its not just a place for you to collect your online purchases or see what gold bling lights up your eyes. Here, we are specially trained to pinpoint weaknesses in your precious metals portfolio and identify ways to bolster up your holdings. To maximize your purchases, speak to us to see what is the best way to go about it. There’s various ways, for example from reviewing your portfolio balance, aligning your risk profile, etc.

- Collateral Loan

Trust us, we mean serious business when we say you should consider utilizing Collateral Loan services. Its not just about braving occasional social stigma and “pawning” your jewellery for urgent funds, it’s all about obtaining credit lines while retaining ownership of your assets for the capital gains via price appreciations. Serious investors know what we’re talking about. If you’re not sure yet am interested to find out more, just reach out to us and we’ll help you become one.

- Asset on your Balance Sheet

You belong to a very select group of customers where it’s not always just about making money. Sometimes, you are planning for your future, or maybe even your children’s future. And you want to give them the best in their lives. Maybe even a good head start in their financial journey. Some Singaporeans buy flats under their children’s name, you buy precious metals for them. After all, its internationally recognized and much more liquid.

We also have ways to value add to you!

- Storage

When it comes to your physical assets, we believe security concerns shouldn’t even be a pain factor. And yet, precious metals investors face issues such as insurance headaches, safety deposit boxes gross weights and size constraints. Just thinking about it gives me a headache already, how about you? That’s why our storage program is an all-in-one solution and provides the full suite of services you will need. From the day of your first purchase, till the day your grandson/granddaughter wishes to sell it off, we maintain your account and offer you a direct line to us. Especially if you are located overseas.

- Perth Mint Certificate Program (PMCP)

Investing your funds in the world’s only Government Guaranteed program for Gold is a no brainer for a serious investor. Perth Mint holds itself to the highest of standards when it comes to vault security and transparency. When you choose PMCP to be part of your portfolio, you needn’t worry about not leaving behind the best legacy. It’s not just a paper certificate, it’s a mobile and internationally recognized asset you can put in your pocket wherever you travel to.

- GoldSilver Central Savings Accumulation Program (GSAP)

When I purchase an investment, I face this issue. How do I know the price I purchase at is a “low price”. The truth is nobody knows. And that’s why it’s so important for you to leverage upon financial wisdom. Dollar Cost Averaging Strategy is the crux here, and when you onboard the GSAP, accumulating daily is stress-free. Think of it as automated disciplined savings for your purse strings. More discipline in your life isn’t such a bad thing.

Earlier, I mentioned that investors fall into the 2 above categories. Truth be told, you feel that both categories do apply to you right? And that’s so true! It all depends on your life stage and goals. So I implore you, get in touch with us to find out how we can maximize each category in your portfolio.

Jason

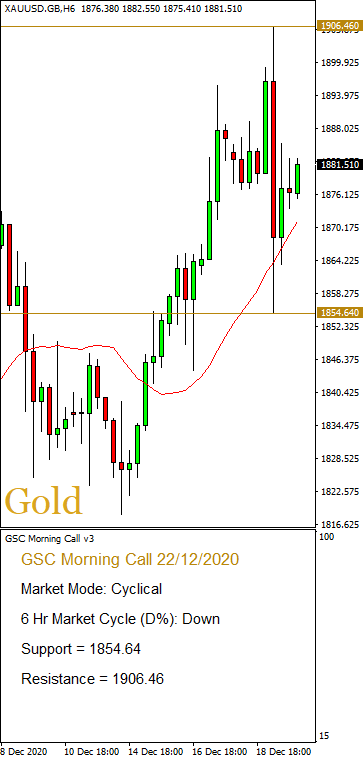

Technical analysts use support and resistance levels to identify price points on a chart where

- Buying force concentrates and exceeds selling force – Support level

- Selling force concentrates and exceeds buying force- Resistance level

The support and resistance levels can be identified on charts using trendlines and moving averages based on the historic price movements.

In terms of technical analysis, the simple resistance level can be obtained by drawing a line along the highest highs for the time period being considered. In contrast, the support level can be obtained by drawing a line along the lowest low.

There are 2 scenarios that may happen when the price level,

- Bounce; or

- Break through

During the “Bounce”, investors usually:

- Buy when the price falls towards support.

- Sell when the price rises towards resistance.

During the “Break Through”, investor usually:

- Buy when the price breaks up through resistance.

- Sell when the price breaks down through support.

Please feel free to speak to us at [email protected] or call us at +6562229703 to speak to our in-house analysts and they’ll be happy to share more with you!

Suzane