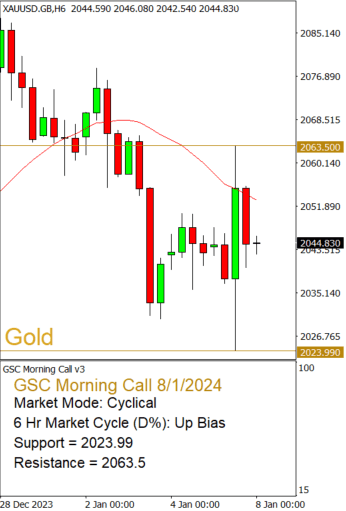

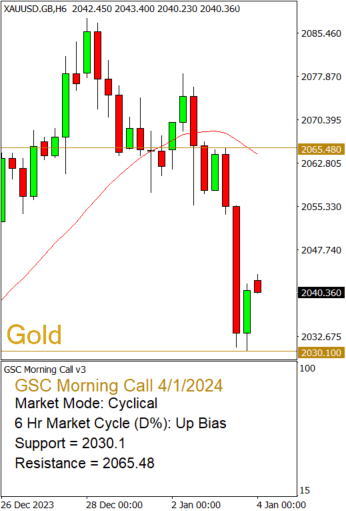

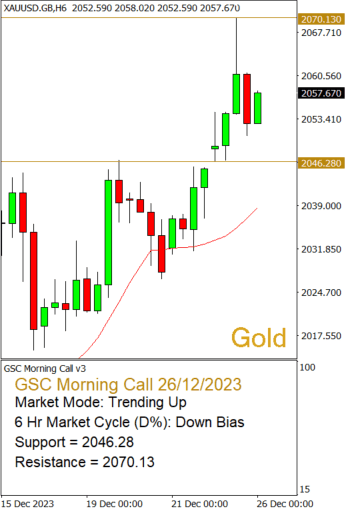

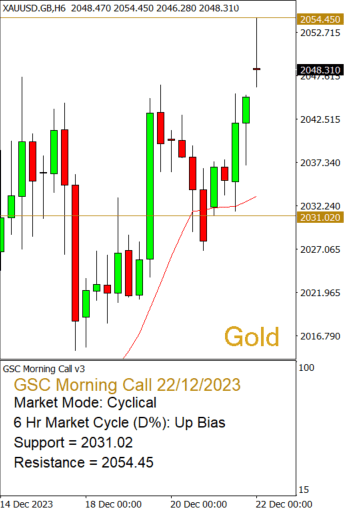

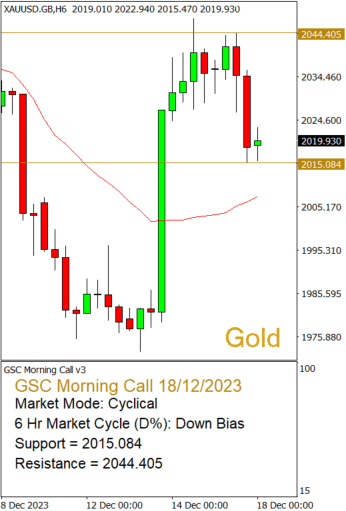

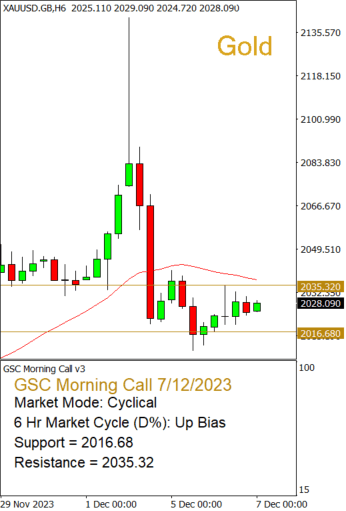

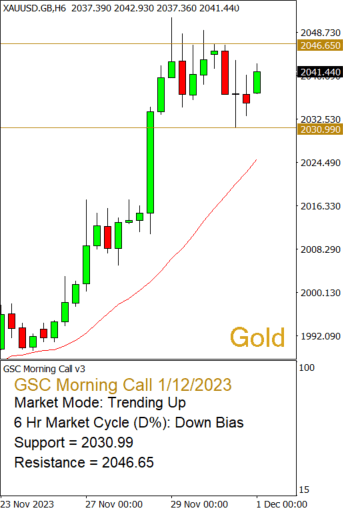

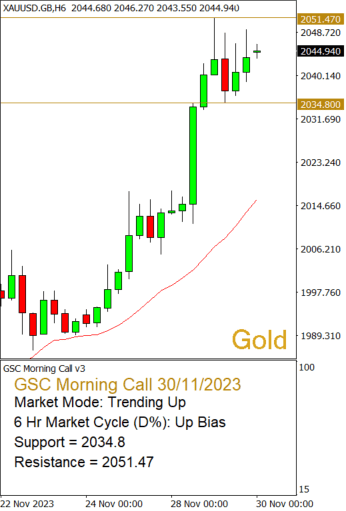

Gold prices experienced a substantial surge of 11.61% or $214.55 in Q4, aligning closely with our revised projection unveiled on October 23, 2023. As we transition into Q1 2024, our system indicates that Gold maintains its cyclical uptrend, with the bulls retaining control. There is a potential move to test the strength of supply at the US$2,144.72/oz level, representing the 2023 year high for Gold.

Throughout Q4, Silver prices saw a 7.45% or $1.65 increase, trading within a range initiated in Q2 2023 but surpassing our initial projections. Looking ahead to Q1 2024, our system shows that Silver prices will persist in a range-bound pattern, albeit leaning towards the upside. The bulls have identified a target at US$25.91/oz, mirroring the peak in Silver during Q4 2023.

Our system suggests that in the event of a continued uptrend in the precious metals market this quarter, Gold may exhibit stronger performance compared to Silver.

Platinum prices closed Q4 with an increase of $82.78 or 9.16%, aligning with our Q4 projection. Moving into Q1 2024, our system projects that Platinum prices will remain within a range but with a bias towards the upside. The bulls are eyeing a target at US$1007.61/oz, reflecting the quarter high for Platinum in Q4 2023.

Please feel free to contact us if you require additional information or have any further questions regarding our Q4 outlook for precious metals. We are always here to assist you and wish you a successful trading experience! Happy Trading!