Gold has never been something that I want to own all along – instead now I believe it is one of the best assets for me to own right now

A summer low in Gold is frequent enough to be noticeable, but not consistent enough to be reliable. Somehow like my erratic mood swings.

Much younger days, I used to think that Gold jewellery is so old fashioned, and the bling bling feel is too loud to be worn as an accessory. It has never crossed my mind even to own it.

However, Gold tends to fascinate and grows on me more when I finally get in touch with precious metals in GSC, changing my perspective on owning Gold bullion. Also after realising the value of Gold and every investor is different; those who invest in Gold do so for a variety of reasons. Investing in Gold has never been so popular. Valued for its ability to perform well during times of boom and bust, Gold has been trusted by investors all over the world for millenniums. The fact is investors who started accumulating bullion in the early years when Gold price was so low had made their profits as of now regardless how the prices fluctuate through these years. Witnessing the investors that I had come across from the time I learn about bullion, they invested and had multiplied over the years, and now they are harvesting their fruits – the gains. Of course, these are long term holders of Gold and has always held Gold in their portfolio; they have also been optimising their portfolio, using other tools such as borrowing against their holdings or liquidating it when it has appreciated to move into other asset classes and then move back into Gold when it seems like Gold will outperform other asset classes. These are all available and offered by GSC, feel free to reach out to us or click here to drop us an email for us to follow up with you.

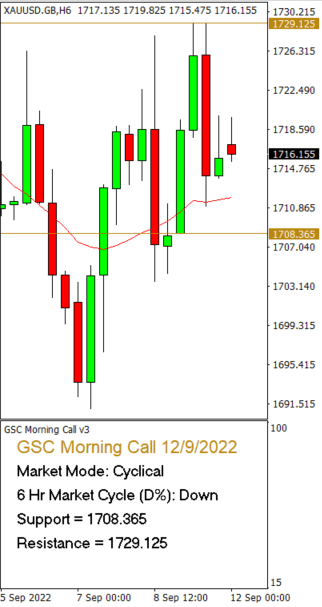

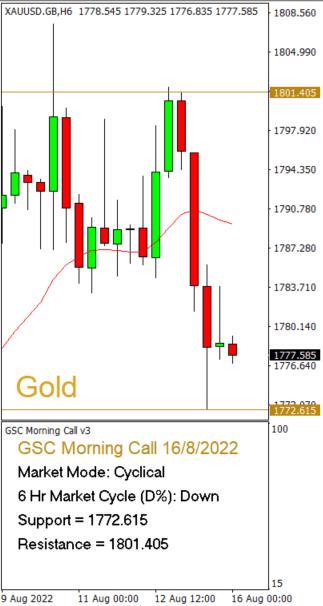

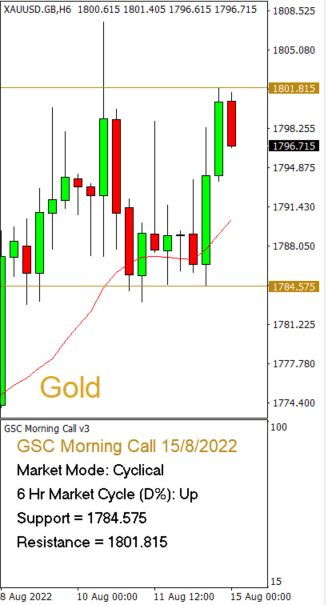

Nothing beats the foresights and trust those investors had in bullion all the time despite the volatility and fluctuation in the Gold prices. In terms of price, the high for the year was $2,072 per ounce – in March, shortly after Russia invaded Ukraine. The low for the year was $1,680 – that came in end July. Currently Gold is just above S$1700 levels and is worth looking at.

Gold is something that you can own physically at any point of time, no counterparty risk and glad I do have some as they were gifted to me, and I’m truly blessed for that. I’ve strongly believe it’s a way for wealth preservation regardless of time, and more so in an impending recession!

Connie

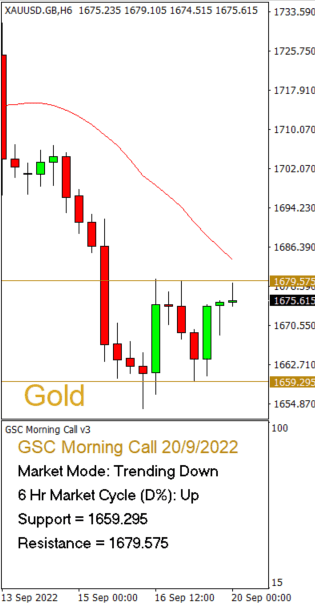

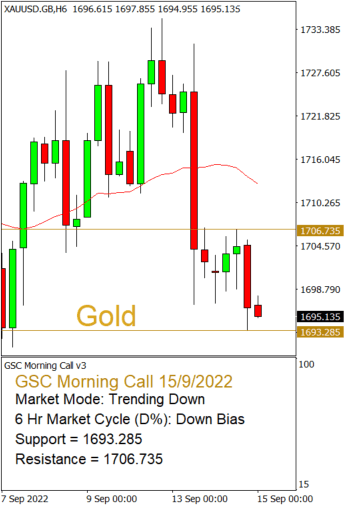

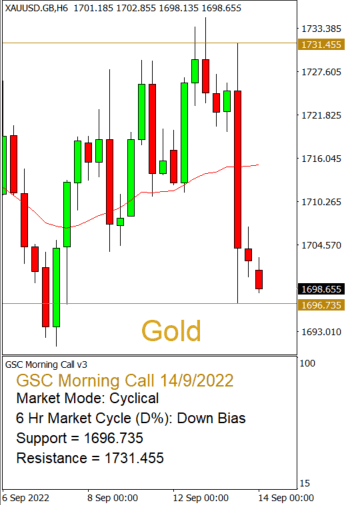

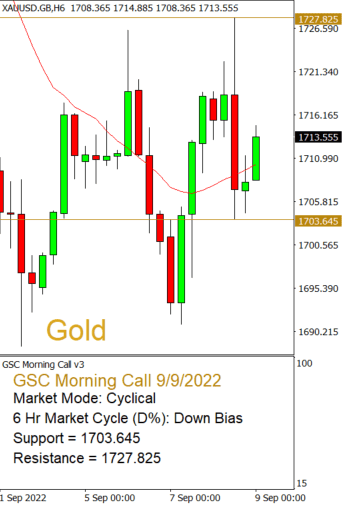

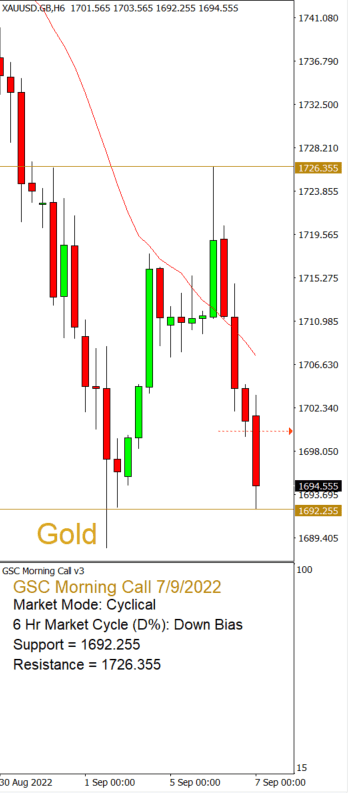

We have seen ETF outflows and falling open interests in Gold futures thus far, seems like the “summer doldrums” as many coined this term for Gold is back after being absent for the last 2 years.

Interestingly, World Gold Council has released Central bank Gold data and Central banks were net buyers of Gold up to July. These price levels seem to be attractive to Central banks and if this will continue to later parts of this year is yet to be seen.

WGC has reported that Gold is doing well in many currencies except in USD, CAD and we know for SGD (Table 1)too thus far. Based on their report, Gold is seems to be a good asset class to hold during recessions together with corporate and treasury bonds (Chart 1). However, at this moment, we are not in a recession and even if US enters into a recession, will Gold continue to shine during this period? It is important to be diversified to tide through difficult periods and seize opportunities when it presents itself. Holding precious metals in a portfolio is important and seems to make sense based on the data presented, however, the rule of thumb is always not to put all your eggs in one basket.

Chart 1:

Brian

“I was accumulating my Precious Metals investment and now prices are going down. Should I continue or stop?”

“I needed some cash flow but to sell my holdings now puts me at a loss, should I just sell and take the losses?”

The above are some of the situations we’ve heard from investors lately. There are various solutions, and we would like to share a few in this article.

At the end of the day, it really depends on what your objectives are and which are the most suitable or comfortable for you to execute. Generally, most people accumulate Precious Metals to hold for the long term. Some even use Precious Metals as part of their legacy planning. As such, when prices are down, investors should grab this opportunity to accumulate more holdings which will bring down the average acquisition cost.

Another good practice is to allocate a standard investment sum monthly to buy/accumulate consistently (daily). This exercise will help you accumulate more metals when prices are low and accumulate less when prices are high.

If you are paying for the storage fee or holding cost, it means your average cost will just keep going up. However, if you continue to accumulate, your average cost may go up or it may stay stagnant.

We’ve seen scenarios where investors will decided to sell their holdings and re-purchase with an accumulation plan. This example is considered a little extreme but it does help cut down the current monthly storage/holding cost when re-purchasing at a new lower average cost. This helps investors who may have limited funds and are unable to fork out more for the storage/holding cost, but at the same time, would like to continue holding this asset.

For the above scenario, there is another way to approach this which is to collateralise the asset. Investors can choose to still own the asset by collateralising it to get some funding. There will still be some interests’ charges, but at least this method will resolve short-term financing issues. Many have opted for this approach to carry them through tough times or to wait for the prices to move higher to sell at a better rate.

We’re just sharing some of the common approaches to managing Precious Metals holdings in the event of falling prices, but these are definitely not the only options.

Please feel free to reach out to us and we are more than happy to discuss more with you!

Suzane

Today I will be sharing varying types of security features in place from various bullion manufacturers to prevent the circulation of counterfeit bullion bars in the trade.

I will be sharing a few of the popular brands and their security features. This includes Argor Heraeus, Valcambi, Metalor and last but not least, Pamp Suisse.

Argor Heraeus is using the Kinegram technology for their precious metal products. This results in a defractive image embossed into the substrate of the metal, which not only creates a mesmerizing effect, but also adds to its authenticity. They are also packaged in unique tamper-proof sealed eco-compatible PET blister packs. This results in a beautiful and secure presentation for the gold bars inside.

Valcambi is using a type of authentication technology developed in Switzerland by paira suisse. It can be identified by the presence o

Metalor has applied a special high-security ink to the surface of the bullion adding negligible weight. The authenticity process is broken into three parts, visual check of security seal, quick verification using a blinking light system and a unique QR code embedded in the seal. This allows for immediate verification of security seals even with limited space, lighting and without an internet connection. In short, 100 kilobars can be checked in less than one minute.

To summarise, there are many security features to be aware of and many counterfeits circulating in the market currently. It is in your best interest to look for a reputable bullion dealer should you decide to invest in bullion assets. With the industry leading tools and years of experience, we can make your bullion journey a smooth sailing one. Feel free to check out our store or call us up should you have any questions on starting your bullion journey.

Dillon

Did you know that there are 118 elements in the periodic table, and around 92 of them are metals. What do you think separates Precious Metals from base metals?

Come, let’s explore the differences between these types of metals today.

As its name suggests, Precious Metals are scarce. Commonly known as Gold, Silver or Platinum these metals are also highly durable and often used in the production of fine jewelry as well as in industrial capacities.

Historically, gold was used as a form of exchange way before the introduction of fiat currency.

In contrast, base metals are cheap, abundant and can be easily sourced. Examples of base metals include copper, lead, nickel, zinc and aluminum. Also, base metals are not corrosion resistant and are easily tarnished. In the US, corroded pennies are a common sight these days.

How to invest in precious metals and base metals?

There are several ways for anyone to invest in Precious Metals such as physical bullion, future contracts or Exchange Traded Funds (ETFs). The most secure way is owning a physical bullion as there are no counterparty risks involved. The owner can directly sell or trade it anywhere in the world.

For base metals, investors can trade its future contracts or through Exchange Traded Funds (ETFs). Both are cost effective, transparent and convenient ways to invest in base metals. You also don’t need to worry about storage. The costs for production (premiums) are also excluded from the ETFs.

Precious Metals (as they are highly liquid) will have thinner spreads as investors are always on the lookout to purchase them for the best price. On the other hand, base metals have a wider spread as they are illiquid when compared to Precious Metals such as Gold or Silver.

A wider bid/ask spread is an indirect cost in trading, especially for huge orders. A wider spread will equate to a higher premium for investors. To minimize volatility, using a limit order is a better option. GSC Live! allows you to place a limit order at your desired price with narrower spreads anytime, anywhere!

Read more about GSC Live!

Hopefully, this article has given you a basic understanding of the differences between Precious Metals and base metals. If you are interested in investing, buying or selling Precious Metals, feel free to reach out to us as we carry a wide range of LBMA accredited Gold, Silver and Platinum bullion that can help you diversify your investment portfolio.

Evonne

Today, I will be sharing with you some of the possible reasons that led to the recent fall in prices of Gold and Silver. Some contributing factors include the strength of the US dollar, high inflation that led to governments raising interest rates to combat rising inflation and industrial demand coming under pressure.

The price of precious metals and the US dollar tend to be inversely correlated. The dollar is trading close to its 20-year high, even the Euro which was the stronger currency has fallen parity against the dollar. The strength of the dollar is a result of capital flowing into the US dollar as investors deemed it as a safe haven asset spurred by the fear of a global recession.

Next, due to the aggressive monetary policy (increasing interest rates) to curb inflation, this in turn hurts the sentiment in precious metals since investors can yield a higher interest in seemingly safer treasury bonds. Usually, high inflation (latest data for inflation rate in US is 9.1%, highest in 40 years) is seen as positive for Gold and Silver prices, but this time interest rates also surged sharply due to government intervention mentioned above. Most investors will definitely look to next Wednesday’s (27th July) Fed meeting to know if the interest rates will be raised by 75 or 100 basis points.

Lastly, relating to industrial demand, Silver is considered both an investment precious metal and an industrial metal; 60% of Silver’s demand is from the industries. Demand for industrial goods reduces all over the world especially in China, due to Covid lockdowns which in turn caused silver prices to take a hit.

I hope you guys have a clearer macro-overview on what is happening globally that led to the fall in prices of Gold and Silver.

If you have any questions, please feel free to contact us to understand more. In the meantime, stay safe!

Dillon