The prices of Precious Metals fluctuate every millisecond. But what exactly affects or determines the prices? Supply and demand? Of course, that is one of the many common answers we hear. Let’s look at some of the other factors affecting the prices of Precious Metals today!

Dollar Index

The Dollar’s strength and weakness can affect Gold prices as the value of Gold and Dollars are inversely related. When the Dollar value increases, Gold prices tend to be lower, and vice versa when the Dollar value decreases.

Inflation

Gold is often seen as a safe haven to hedge against inflation due to its ability to retain value amidst falling economies based on past historical data. When Dollar weakens, it will most likely drive inflation rates up and cause Gold prices to spike. We can view Gold as an alternative currency to hedge against inflation in a broader sense.

Economic factors/events

Let’s take the recent Russia-Ukraine War as an example. Upon Russia’s invasion of Ukraine, Gold surged to a high of over US$2,000/oz right after the announcement of the Russian oil import ban by the United States. Investors had rushed and opted for Gold as a safe haven with the invasion and information, driving prices up as demand surged.

Demand and Supply

Gold is a highly coveted commodity that has been used for a variety of purposes such as consumer goods or industrial sectors such as Gold jewellery, dentistry, electronics and more. When the demand for these increases, the prices of Gold will rise; also, when there is a scarce supply, the prices will increase too. For example, if lesser Gold is mined and the amount of Gold is not sufficient to meet global demands, Gold will experience a surge in price. Therefore, demand and supply play a crucial role in determining Gold prices.

I hope you guys have a better understanding of the factors that affect the price movements of Precious Metals. You may also wonder why different Bullion dealers or platforms offer different spot prices. We have discussed this topic before, and you can read more about it here.

If you have any questions, please feel free to contact us to understand more. In the meantime, stay safe!

Evonne

Across the years, I have had the opportunity to come across many new investors looking to add Precious Metals into their portfolio. “Should I buy Gold or Silver? Or both?” This is a question that I hear frequently, and the answer really depends on what each individual is looking for. Let’s first discuss on the use of these two precious metals.

Gold is a Precious Metal that is well known for two key uses – a safe-haven metal, an alternative asset useful for portfolio diversification and as a main product used in the jewellery market. China and India, two of the largest market for physical Gold, have demand for the yellow metal throughout the year and experience a spurt in demand during festivals when it is their custom to gift Gold to their loved ones. The physical demand in these two markets provides support when Gold prices consolidate as jewellers tend to bargain hunt when Gold prices fall. On the other hand, while Silver receives some of the safe-haven flows, it is a metal that consists of industrial uses; hence the price movements for commodities do affect Silver too. Silver is the world’s best conductor and is therefore used in cars, solar technology, and many electronics.

Despite the differences between the two metals, both metals’ prices share a robust positive correlation.

Throughout the last decade, there have only been a few instances when the correlation between the two metals fell into the negative zone. A positive correlation means that the prices for both metals tend to move in the same direction but to a different extent.

Here is the yearly performance for both metals for the last 10 years:

Lastly, to measure how Gold and Silver perform against each other, the Gold Silver Ratio will be a helpful tool to visualize this relationship.

As shown, the gap between the two precious metals was the narrowest during the week of 17th April 2011 at 31 before widening and eventually topping out at 119 during the peak of Covid-19 pandemic. It was during the pandemic that Gold received strong interest, while Silver did not receive the same extent of safe-haven flows in comparison. Inflation rates have been persistent, as commodities go on a strong rally. Silver has also been catching up with Gold at the same time, hovering near 75 presently.

Note, as this is a ratio, Gold against Silver, this ratio can go up in 4 scenarios if

- Gold goes up and Silver goes down.

- Gold goes up more than Silver goes up.

- Gold stays stagnant and Silver goes down.

- Gold goes up and Silver stays stagnant.

Vice Versa, the reverse for points 1 to 4 will be true for Gold Silver ratio when it goes down instead.

Investors have to determine which scenario it is that led to the higher or lower ratio and their objective for using this ratio.

Sin Pong

GOLDEN MOMENTS

Should you be wondering what is in-store for Daddy dearest on this very special Father’s Day, take a little time off to shop online with GoldSilver Central, just one click away!

https://www.goldsilvercentral.com.sg/shop/

Every celebratory occasion is a special experience. Most of the time, we put in utmost thought into buying a special gift for someone close to our hearts – the one who means a lot in our lives.

The most heartfelt gifts are the ones that truly take one by surprise and create that spontaneous smile in that special one’s face. Thoughtful gifting does not have to involve spending extra money or concocting an elaborate setup. It is in the seemingly simple action of being in sync with the thoughts of people whom you love and that induces the most heartwarming gifts and gestures.

GOLD

- makes an unbeatable impression when given to your loved ones.

- serves as wealth preservation.

- becomes a gift with heritage value.

You may ask, on what occasion does Gold make an appropriate gift? Traditionally, Gold bars and coins are given with congratulatory intentions for wedding, birthday or welcoming of newborns. There is no better start for a newlywed couple to receive Gold as a valuable form of savings for their future. Bestowing Gold on newborns is also popular. Even an annual affair in presenting these shiny bullion for Father’s Day is the best way to show your love for your father.

At GoldSilver Central, we are your one stop solution for all your Precious Metals Needs including gift ideas! Shop at GoldSilver Central today!

Connie

One of the most important information all investors would like to know is the prices trend. Prices have a propensity to move directional, forming a trend and trends likely to persist over time.

Peaks and troughs are pattern that are developed by the price movement. Trends are determined by a series of these patterns.

How can we determine the trendline has been broken or not? Witness the breakdown and then replacement of the peaks and troughs.

But be careful you do not make the mistake of using a time frame that is too short. Peaks and troughs are developed over weeks and months of price action, not hours and days of trading.

Daily candlestick is used in the chart for illustration. Each bar represents one day of price movement.

Below is the chart showing the uptrend.

Below is the chart showing the downtrend.

Below is the chart showing the sideways (consolidation).

Suzane

I’ve recently been bombarded with new ideas and information, many of which I cannot digest immediately. There is one concept amongst all which I find interesting and would like to share with you. I believe that a large part of why people want to learn about investing involves dreams like improving their lives and achieving financial freedom. Who wouldn’t want to live and enjoy life without worries (such as living expenses, parental support, children’s tuition fees, etc.)? So, we learn to invest with hopes of improving our financial situation and preparing for the unknown future.

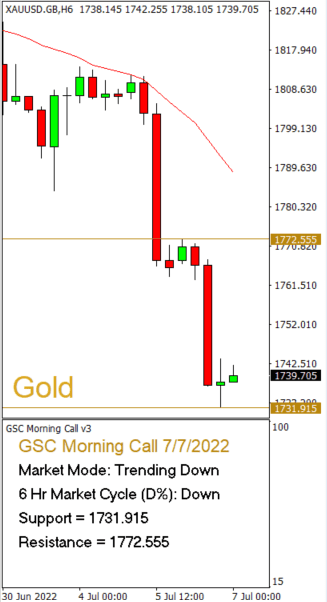

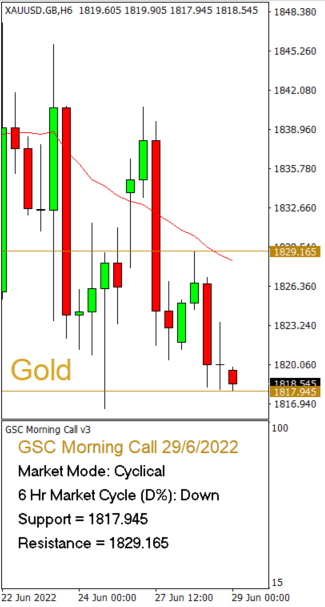

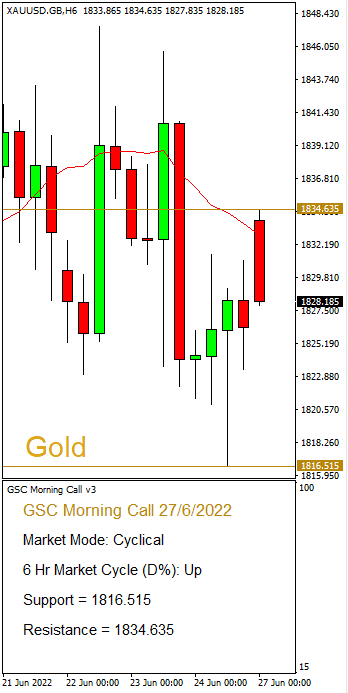

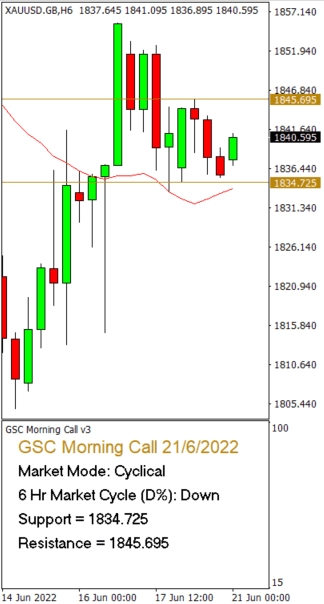

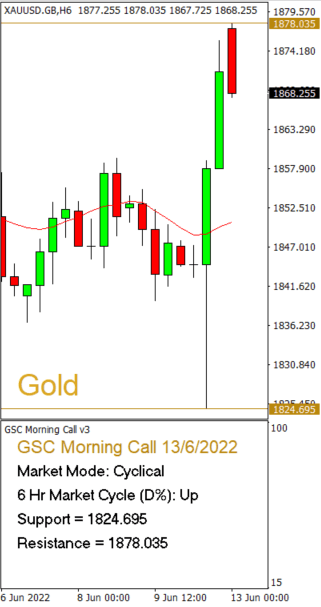

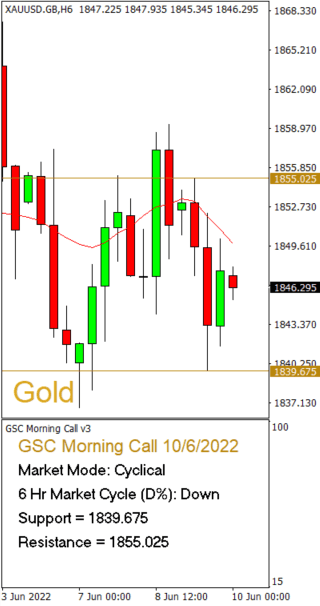

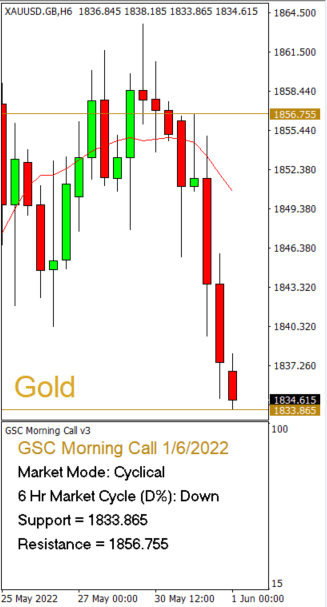

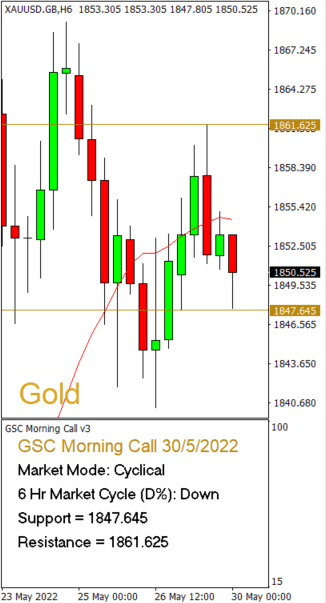

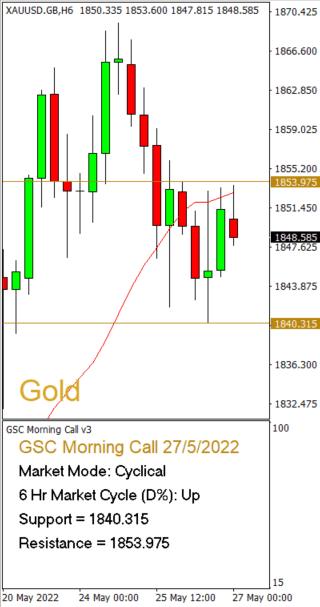

Today, I will not discuss which investment or Precious Metal is a better choice because we must recognize the more important point – to judge the market trend. If we can’t tell if the market is going up or down, we will not be able to decide whether to buy or sell no matter the kind of investment, agree? There is too much fake news being distributed amidst the real ones on the internet. Unlike senior economists and analysts who have the means to filter and analyze data from various sources to predict market trends, most of us cannot do it on our own. So, what can we do?

You might start to wonder if it will be great if there is an application that can tell you if the market is going to go up or down during a specific time frame and receive automatic reminders on price levels when it reaches your desired price level? With a “smart investment” application like this, many investment strategies can be simplified and automated, allowing us to spend our free time and energy on other meaningful activities in life, such as spending time with our family while making money. Would you be excited to try it if I told you we have an application on hand to make your journey in Precious Metals investment a little easier? We welcome you leave your contact details (click here) with us to learn more about how this application can change how you invest in Precious Metals.

最近我时常被各种新思想新资讯轰炸,很多都没办法立刻消化。可是当中有一个概念我觉得很有趣,希望可以分享给各位。首先,我相信大家想学习投资的理由很大部分和改善生活以及实现财务自由等梦想有关。谁不希望可以享受人生,无需担忧吃穿用度、供养父母、子女学费和退休生活呢?所以我们学习投资,希望可以改善自己的经济状况和为未知的将来做好准备。

今天我就不讨论哪种投资或哪个贵金属比较好,因为我们必须认清更重要的一点,那就是——判断市场趋势。无论是哪种投资,如果我们无法判断现在是上升还是下跌的市场,我们就无法决定到底是要买入还是卖出。同意吗?而网上太多消息真假混杂,我们大部分人不像资深经济学家、分析员等有办法从各方面的信息中筛选过滤分析数据来预测市场走向。那怎么办呢?

这时候我们可能会想如果有一个应用程式可以告诉我们接下来一个特定时间里市场是会上升或下跌,还可以自动提醒是否已经达到我们所要的价位,那该多好啊。有了这么一个“智能投资“应用程式,很多投资策略可以简单化、自动化,让我们赚钱之余可以把空出来的时间精力投入到人生其他有意义的活动中比如陪伴我们的家人。如果我告诉你我们手上就有这么一个应用程式,可以帮你在投资贵金属的旅程中走得轻松一些,你会为此兴奋跃跃欲试吗?欢迎你留下你的联络方式 (点击这里),和我们一起了解这个可能改变你如何投资贵金属的方案。

Maya

In our previous article on how to set price alerts to buy and sell on our website. Now, would you be interested to know more about setting price alerts using our platform (GSC Live!)? It is an awesome tool to help in setting price alerts for most of us who are always on our desk – alerts can only be set using the desktop version only. “How?” you wonder. Well, all our clients are entitled to a complimentary non-tradeable account to log in and view prices on GSC Live!.

To set price alerts, click into the “Alerts” tab, right click your mouse and start creating alerts and notifications! It’s amazing that you can even set an expiry date for the alert so that it will not notify you once it expires, even if it hit your desired level after the alert expires.

*Only the desktop application can set alerts and you have to be in the application to get notified when the alert triggers.

Wait a minute, what IF you missed the alert as you were caught up in an appointment, or the price level hit while you were sleeping? Don’t worry! Activate your account on GSC Live! to execute the orders for you by setting buy / sell limits. The difference between setting buy/sell limits and alert notifications is that the order will be executed immediately upon reaching your desired price level. If you prefer a simpler way of getting a price alert for your physical Gold, Silver or Platinum bar, you can also set it up via our website! I’ve shared this in my previous article and you can refer to it here! You will not have to worry about missing the notifications or alerts on your preferred price level anymore!

Speak with us to find out more about GSC Live! at 6222 9703 or email to [email protected].

Suzane

Since the Russia-Ukraine invasion, Gold experienced a magnificent roller coaster ride, and we witnessed a wave of physical gold holders selling their yellow metal to cash out at another historical high price of nearing US$2,040/oz. At the same time, investors and retail sales were outweighed by a jump in demand, led by a surge in new first-time buyers as prices hit new or near all-time highs against the world’s major currencies amid worsening inflation and Russia’s Invasion of Ukraine.

As global economics battle with the after tremors of Covid-19 in the form of inflation, Singapore’s annual inflation rate accelerated to 4.3% in February 2022 from 4.0% in the previous two months. As inflation runs rampant, what does that mean for us? Soaring prices for food, transport services, fuel, groceries, literally everything is pricier.

On the ground, we are witnessing an influx of buyers with the intent to hedge using both gold and silver bars. Interestingly, even with various agendas behind the buying spree, most buyers concurred that physical hedging is essential in times like this.

Do you think that gold is going to go up indefinitely? Probably not. You hold an asset in your portfolio as ballast, as downside protection. It doesn’t pay any dividends, much like bitcoin. You are not holding it for its lack of volatility through time.

Gold is said to stand for many things, and some widely misunderstand it as an actual store of value: protection of wealth. Its price can be argued as many things, but what it could stand for: an insurance policy. How much exactly are you insured in your portfolio?

Mindy