Introduction

Numismatics are often associated with being coins that are both rare and ancient. The value of numismatics goes beyond its currency because of their significance and unique historical values.

This article focuses on the extended knowledge of numismatics.

Coin Grading

The Sheldon Scale was introduced by Dr. William Sheldon, a renowned numismatist in 1948. The Sheldon Scale is now internationally recognized and used widely in the coins and numismatics industry. It is a point system scale, ranking coins from a scale of 1 to 70. The higher the grade, the better the condition of the coin is. To account for a wider range of coins, the Sheldon Scale had been modified. Below are the grades and explanations:

MS/PR-70 (Mint State/Proof): A coin with no post-production imperfections at 5x magnification.

MS/PR-69: A fully struck coin with nearly imperceptible imperfections.

MS/PR-68: Very sharply struck with only minuscule imperfections.

MS/PR-67: Sharply struck with only a few imperfections.

MS/PR-66: Very well struck with minimal marks and hairlines.

MS/PR-65: Well struck with moderate marks or hairlines.

MS/PR-64: Average or better strike with several obvious marks, hairlines and other minuscule imperfections.

MS/PR-63: Slightly weak or average strike with moderate abrasions and hairlines of varying sizes.

MS/PR-62: Slightly weak or average strike with no trace of wear. More or larger abrasions than an MS/PF-63.

MS/PR-61: Weak or average strike with no trace of wear. More marks and/or multiple large abrasions.

MS/PR-60: Weak or average strike with no trace of wear. Numerous abrasions, hairlines and/or large marks.

AU-58 (About Uncirculated): Slight wear on the highest points of the design. Full details.

AU-55: Slight wear on less than 50% of the design. Full details.

AU-53: Slight wear on more than 50% of the design. Full details, except for very minor softness on the high points.

AU-50: Slight wear on more than 50% of the design. Full details, except for minor softness on the high points.

XF-45 (Extremely Fine): Complete details with minor wear on some of the high points.

XF-40: Complete details with minor wear on most of the high points.

VF-35 (Very Fine): Complete details with wear on all the high points.

VF-30: Nearly complete details with moderate softness on the design areas.

VF-25: Nearly complete details with more softness on the design areas.

VF-20:Moderate design detail with sharp letters and digits.

F-15 (Fine): Recessed areas show slight softness. Letters and digits are sharp.

F-12: Recessed areas show more softness. Letters and digits are sharp.

VG-10 (Very Good): Wear throughout the design. Letters and digits show softness.

VG-8: Wear throughout the design. Letters and digits show more softness.

G-6 (Good): Peripheral letters and digits are full. Rims are sharp.

G-4: Peripheral letters and digits are nearly full. Rims exhibit wear.

AG-3 (About Good): Most letters and digits are readable. Rims are worn into the fields.

FR-2 (Fair): Some details are visible. Rims are barely visible.

PO-1 (Poor): Enough detail to identify the coin’s date and type. Rims are flat or nearly flat.

Ungradable: Date and mintmark of the coin are undetectable, which is necessary for grading.

Coin Grading Organization

If you are looking to get your coins professionally graded, you may want to consider visiting reputable and well known coin grading companies like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Corporation) to get the coins graded. Graded coins will be certified as authentic, protected and held with a holder, and can be sold for a higher value to coin collectors or dealers who are willing to pay higher premiums for a relatively rare coin.

Numismatics vs Bullion

Bullion are generally purchased as a form of investment or to hedge against inflation. Bullion are valued based on their purity, weight, and spot metal price. Below are some examples of investment grade bullion coins for your consideration if you are looking to purchase as a form of investment:

- Canadian Maple Leaf

- American Eagle

- Austrian Philharmonic

- Royal Mint’s Britannia

- Perth Mint’s Lunar Series

However, numismatics on the other hand, are extremely rare and collectible as they are historically significant pieces. Therefore, they are valued based on their rarity, condition, mintage or year. Some famous numismatics coins are:

- Pre-1933 American Eagle

- Morgan Silver Dollars

- Peace Silver Dollars

It is crucial to know your objective when you put into consideration of whether to purchase bullion or numismatics. This is because a bullion coin may be a better choice if you are looking for an asset to invest due to lower premiums.

I hope you have a better understanding of numismatics now! Do connect with us at [email protected] or WhatsApp us at +65 8893 9255 if there is any specific numismatics coin that you are looking for, or if you have a coin and wondering if it could fetch a numismatics value. Meanwhile, if you are interested, we have a range of numismatics certified by PCGS and NGC here!

Evonne

Many of our clients have brought up the idea of cutting up their Gold bars to periodically sell in smaller denominations. Logically, it makes perfect sense as it is actually a smarter way when it comes to liquidating your holdings. In fact, it is part of a strategy called Dollar-Cost Averaging for selling. By splitting up your holdings equally and selling them in fixed periods, you get an average price over a period instead of liquidating all the Gold bars at one go, allowing you to better manage the price risks.

Another situation which may require you to sell a portion of your Gold bars is when you are rebalancing your portfolio. When the value of your Gold increases and outweighs the allocation you have intended for your portfolio, you will need to sell some of your Gold to ensure the portfolio is balanced accordingly. Nonetheless, we all know that it is definitely not advisable to cut your Gold bars for the purposes mentioned. Once the Gold bar is cut, it loses its value as an investment grade bullion bar and will be treated as scrap gold (for melting), resulting in a lower buyback price.

With GoldSilver Central, there will always be solutions to achieve your intended portfolio. You can sell the intended portion of your Gold holdings through means of Exchange-Traded Funds (ETFs) or Pool-Allocated contracts. Pool allocated contracts on GSC Live! for Gold are available in mini contracts (0.1oz per contract), providing you with the flexibility that you need. You can also convert your physical Gold bars into pool-allocated contracts on GSC Live!. A Gold bar weight 1 KG (32.148oz) can be converted into 32 of the 1oz contracts or even 321 of the 0.1oz contracts! With these solutions made available to you, “cutting” up your Gold bars is now possible without having you to suffer any unnecessary losses during the process.

Do connect with us via a call at +65 6222 9703 or email to [email protected] to find out more about “cutting” up your Gold bars & selling them!

Sin Pong

In times of volatility, the charts and price movement we see blink red and green tirelessly, like a never-ending fast-forward traffic situation. Ever slipped your finger and missed the buy/sell within seconds, for whatever reasons (could be internet connection lagging, could even be that you were taking too long to ponder if you should press that button!) that caused you to miss the perfect price level, must be causing you to secretly curse and swear about how you should have had gotten that price level instead of missing it.

Ever saw a piece of precious metal and fell in love with it immediately, and wishing you could own it someday? Especially so at a price lower than the current price, or at a price that is lower than the average price! Well, you can set a Price Alert to be notified when the price has reached your desired level!

For example, if you’ve always wanted to own a piece of the Argor-Heraeus Kinebar Gold Bar 10g, and wished that you can someday own it when it costs S$820. You can set a price alert on our webpage by heading over to the product’s page (in this example, it would be the Argor-Heraeus Kinebar Gold Bar 10g), click on the “Price Alert and History” tab, and click on “Setup Price Drop Alert”.

Enter the price level you wish to be alerted at, and your email address for the price alert to be created.

Did you know? You can also set price alerts for sale of your pre-loved jewellery to us. If you’ve a rough estimate of the finesse, purity, and weight, you can set an alert to notified when prices are high and worthy of your preloved jewellery. Click on “Alert Me When Prices are Right!” to set your price level to be notified.

Have a piece of pre-loved jewellery you’d like to sell off? Or is there an item you have in mind, with a specific price tagged to it? Connect with us via email at [email protected] or WhatsApp to +65 8893 9255 to find out more about Price Alerts and how to use them to your favour!

Do watch this space for our next article sharing on how to set alerts and notifications using the GSC Live! application. Till then, cheers and stay safe!

Suzane

“Why are your Gold bars and coins cheaper than some jewelers and online retailers?” “Are they pre-loved or defected items?” “What are the differences?” These are questions that we often hear from our retail clients. Today, we will be sharing some information with you on the questions commonly asked by our retail clients, especially when visiting us for the first time:

- It may occur to you that the difference in the prices offered by us and others within the same industry (jewelers, bullion dealers, online retailers, etc.) can be quite vast. Well, this is because a mark-up is included in the products offered by traditional jewelers as it involves crafting and design of jewellery. Most clients who visit traditional jewelers are usually looking for gifts and are willing to pay more for the jewellery piece with the design they adore. In contrast, clients whom purchase from authorized bullion dealers like GoldSilver Central are mostly Precious Metals investors. Therefore, the prices we offer are competitive, as we understand that all physical items are priced at Spot + Premium, and our mark-up is actually the premium! Essentially, premiums are also the cost of fabricating and shipping of the items from the refineries to our retail store. One of our clients shared that they had managed to save more than S$300 by purchasing a Canadian Maple Leaf Gold Coin 1oz from us as compared to purchasing from a jeweler!

- LBMA accredited refineries and mints such as (but not limited to) Argor-Heraeus, Austrian Mint, TianXinYang, Perth Mint, and the Royal Canadian Mint had authorized GoldSilver Central as the authorized distributor of their bullion products. Having had built a good working relationship with the refineries and mints had allowed us to enjoy better premium rates, and we are then able to sell at a lower price to our clients. Other sellers who are not the authorized distributor may had obtained the bullion from a wholesaler or even a 3rd party, incurring higher costs on top of the premium, which is also why our prices are more competitive compared to other retailers/sellers.

We hope the above sharing had answered your question as to why we are able to offer products with attractive premium.

Do connect with us via a call at +65 6222 9703 or email to [email protected] to find out more about physical bullion purchase.

Evonne

Greetings from the GSC Savings Accumulation Program’s Team!

In a few days’ time, we will be celebrating the joyous and festive Lunar New Year! I’m sure there are many who can’t wait to receive blessings in the form of money packed in little red envelopes from our parents and relatives. Well, there are also many of us who will be giving blessings out to our little ones as well as our family and friends. Tradition has it that once you are married, you can give out blessings in the form of red packets to family and friends who are still single, or if you’re single, as a form of expressing appreciation to parents and grandparents for raising us!

Has it ever crossed your minds that we can snowball the angpow money we received by putting it into the GSC Savings Accumulation Program (GSAP), and start accumulating precious metals (Gold, Silver, and/or Platinum)? We can even choose to exchange the accumulated holdings into a physical bar/coin upon plan maturity! Well, we can also accumulate the money we wanted to give our parents and grandparents this year, by putting them into GSAP, and taking physical delivery of an item upon plan maturity, and giving them as a form of Precious Metal instead of the usual plain red packets they receive from everyone else! We can also deliver the items at a small fee, depending on the item you selected, and the delivery location.

Sounds interesting? You can find out more and sign-up for GSAP here. Drop us a text over at +65 8893 9255 or email us at [email protected] and we will be happy to share more with you!

Wishing you and your family a prosperous Lunar New Year!

Wendy

We have come to the end of 2021, let’s look back at how this year started. Many were hopeful as they believed that the Covid pandemic that has “washed out” 2020 would be over, and with Gold prices setting a new high last year, many expected an even higher price set this year. So how did Gold fare this year?

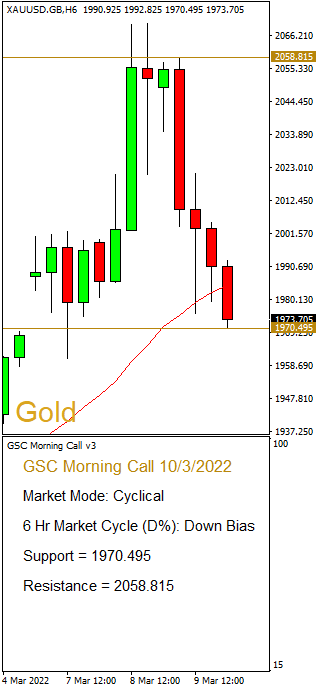

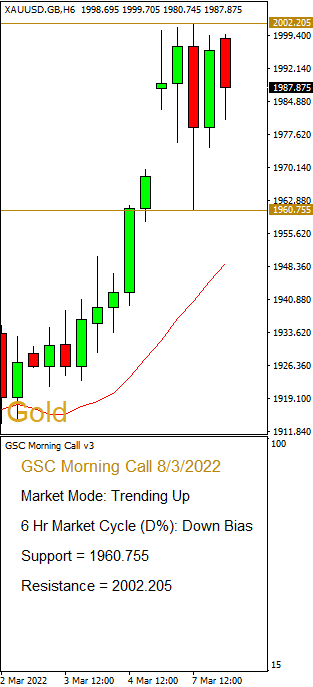

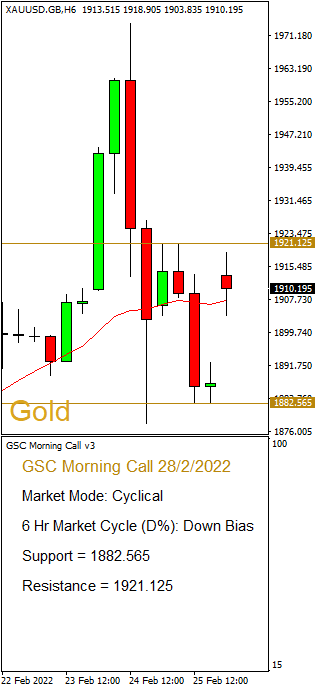

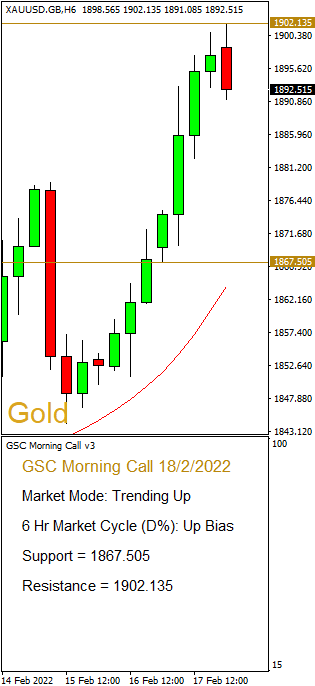

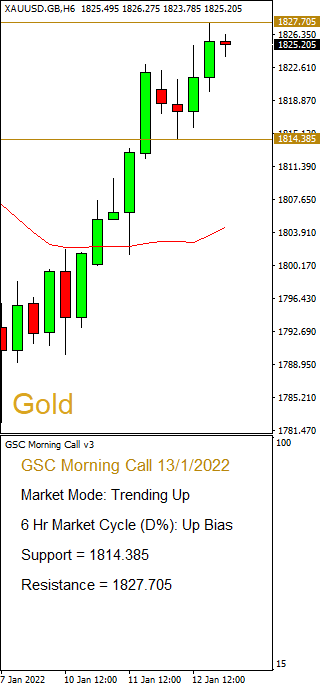

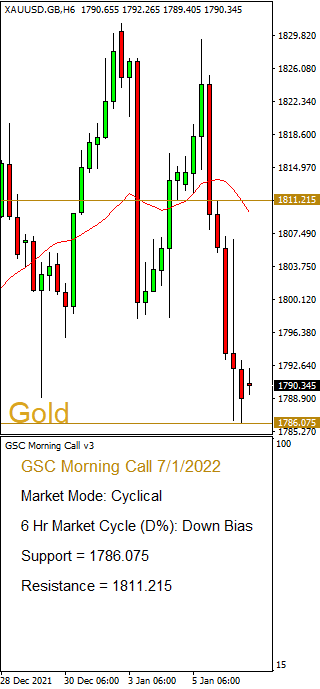

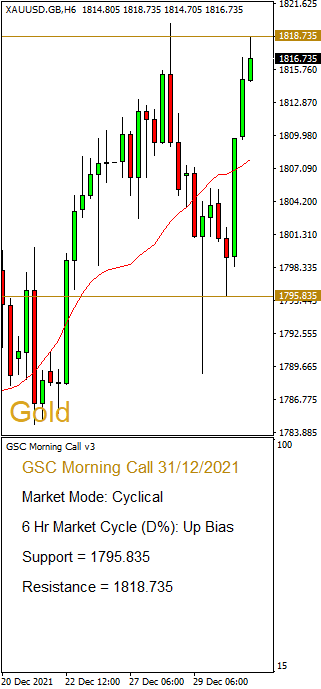

Gold set a high for the year on 6th January at US$1960 per oz before heading down and reached a low of US$1680 three times this year (8th Mar, 31st Mar & 9th Aug). Gold is enroute to close the year at a loss of around 5.5% based on the opening price on 4th January 2021. Gold didn’t perform as well as what we have seen last year (a gain of 25%). However, Gold’s average price this year is the highest we have seen in the history of Gold. Surprise, surprise! This year Gold’s average price is around US$1798 (as of 29th Dec) compared to last year’s average price of US$1769. How will Gold fare in 2022?

Precious Metals Prices in 2022

With a backdrop of huge stimulus by most Central Banks, near to 0 or negative interest rates and highest inflation rates seen in more than 30 years; we believe this will provide good support to precious metals prices in the longer term as we don’t expect this to change within the next 3 to 5 years. We expect precious metals prices to be volatile next year as Central Banks will try to reign in the inflation caused by the stimulus by ending their bond buybacks program and increasing interest rates. This will create volatility in markets and inflation caused by unprecedented stimulus will unlikely be curbed within the next few years. Real interest rates will still remain negative even if the Federal Reserve raise interest rates 3 to 4 times next year due to the high inflation rate.

Moreover, Central Banks who usually wouldn’t buy Gold as part of their reserves might look to buy more Gold amidst this period of uncertainty. Singapore who hasn’t bought Gold in more than 20 years, has bought 26.3 tons of Gold this year. Thailand, Brazil and Japan for example, have bought Gold this year too. We expect more Central Banks to look to Gold to form part of their reserves in 2022.

Hence, we might see Gold testing the price level US$2000, Silver testing US$30 levels and Platinum testing US$1200 levels next year. Buying precious metals when prices pull back or buying using Dollar Cost Averaging strategy are best ways for accumulation. Use the volatility in your favour and remember, don’t put all your eggs in one basket! Other asset classes like equities, currencies, cryptocurrencies, properties are also important to look at in order to build a robust portfolio!

Gratitude

2021 also marks our 10th Anniversary and on behalf of the team in GSC, we want to say a big thank you to all our esteemed clients, business partners, family and friends for your unwavering support, encouragement and for being part of our golden journey.

May this holiday season be a good time for all of us to spend time with family and people who matter! We are thankful that borders have re-opened with Malaysia and many of our colleagues, friends and clients can finally spend time with their family in person.

Here’s to a better 2022 and many more good years together! Happy Holidays and Happy New Year!

Brian Lan, GoldSilver Central’s Managing Director