GoldSilver Central would like to take this opportunity to wish our beloved nation a happy and joyous 58th National Day!

As we celebrate the achievements of our great country, let us also reflect on our past and rejoice in the progress that has been made.

From its humble beginnings as a newly independent state, Singapore has grown to become a prosperous and vibrant nation. We have seen much progress in the last 58 years – from its transformation into a modern city-state, to the development of world-class infrastructure and public services.

Happy 58th National Day Singapore!

Personal Finance: Understanding Its Importance

Before delving into the details, it is crucial to comprehend why personal finance holds such significance. Understanding where your money goes and how to allocate it effectively is key to achieving financial goals. By mastering the fundamentals of personal finance, you gain the power to make better financial decisions.

1.1 Financial Security: A Compelling Drive

One compelling reason to grasp personal finance lies in achieving financial security. By skillfully managing your income and expenses, you empower yourself to save and invest wisely, paving the way for long-term stability.

1.2 Debt Management: Taking Control

A firm grip on personal finance can also aid in managing debt efficiently. By comprehending loan terms and interest rates, you can devise a plan to minimize debt swiftly and effectively.

1.3 Future Planning: Crafting Your Path

Knowledge of personal finance proves invaluable when planning for the future. Whether your dreams involve homeownership, entrepreneurship, or retirement savings, understanding personal finance concepts helps you reach these milestones with greater efficiency.

Setting Financial Goals: Paving the Way

Embarking on personal finance planning necessitates defining your financial goals. It is essential to identify what you strive to achieve with your money before crafting a roadmap to success.

2.1 Short-Term Goals: Embracing the Near Future

Short-term financial goals encompass achievements within the next five years. This may entail paying off credit card debt, saving for a dream vacation, or accumulating a down payment for a car.

2.2 Medium-Term Goals: Embracing the Horizon

Medium-term goals encompass targets to be achieved within the next five to ten years. This could include saving for a home down payment, venturing into entrepreneurship, or paying off student loans.

2.3 Long-Term Goals: Embracing the Journey

Long-term goals encompass financial objectives spanning over ten years. This often involves saving for retirement, funding a child’s education, or building a robust investment portfolio.

Assessing Your Financial Situation: The Starting Point

Once your financial goals are defined, the next step is evaluating your current financial situation. This entails calculating your net worth, which is the difference between your total assets and liabilities.

3.1 Income: Fueling Your Financial Journey

Begin by listing all your sources of monthly income, including your salary, bonuses, commissions, side gig earnings, or any regular inflows.

3.2 Savings: Building Your Safety Net

Next, assess your total savings, encompassing traditional and high-yield savings accounts, certificates of deposit, and money market accounts.

3.3 Investments: Growing Your Wealth

Consider any investments you hold, such as stocks, bonds, precious metals, mutual funds, real estate, or retirement accounts.

3.4 Assets: Valuing Your Worth

List your assets, including your home, car, and any other valuable possessions, using their current market values.

3.5 Expenses: Navigating Your Financial Landscape

Finally, outline all your monthly expenses, ranging from rent or mortgage payments to utility bills, groceries, transportation costs, and other regular expenditures.

By embarking on this journey of understanding and implementing personal finance strategies, you empower yourself to navigate the financial landscape with confidence and achieve your desired financial future.

Creating a Budget: Mastering Your Money

Having a budget is the cornerstone of successful personal finance management. It empowers you to take control of your finances and ensures that you’re living within your means.

4.1 Allocating Funds: Prioritizing Your Priorities

When creating your budget, it’s crucial to allocate funds for your essential expenses first. Think of it as building a solid foundation for your financial well-being. Start by earmarking money for housing, food, and transportation, and then you can indulge in non-essential expenses like entertainment and dining out.

4.2 Paying Off Debt: Breaking Free from the Shackles

Your budget should also include provisions for paying off any lingering debt. Liberating yourself from debt is paramount, as it saves you from paying unnecessary interest charges. Remember, the sooner you pay off your debt, the faster you’ll be on your way to financial freedom.

4.3 Saving for Goals: Dream Big, Save Smart

In addition to expenses, your budget should include savings for your short-term, medium-term, and long-term goals. Make it a habit to pay yourself first by setting aside a portion of your income for savings before allocating money for other expenses. This way, you can turn your dreams into reality.

GSC Savings Accumulation Program (GSAP) is a versatile savings program designed to help people achieve their financial goals. It offers a convenient way to accumulate and manage Precious Metals Holdings in physical Gold, Silver and Platinum. Unlike most savings programs which may require longer periods of time for maturity, you may liquidate your precious metals holdings or convert them into physical precious metals products after a minimum commitment period of 3 months. Learn more about GSAP today!

Preparing for Emergencies: Expecting the Unexpected

Building an emergency fund is an essential part of personal finance management. This fund acts as a financial safety net, ready to catch you when unexpected expenses or financial emergencies arise.

5.1 Importance of an Emergency Fund: Weathering the Storm

An emergency fund is a true lifesaver. It shields you from unexpected costs like car repairs or medical bills without relying on credit cards or loans that can trap you in a cycle of debt. It’s like having your own superhero in times of crisis.

5.2 Size of Emergency Fund: Tailoring it to You

Ideally, your emergency fund should cover three to six months’ worth of living expenses. However, the exact amount depends on your personal circumstances, such as your monthly expenses, income stability, and tolerance for risk. Customize it to suit your needs and sleep soundly knowing you’re prepared.

5.3 Where to Keep Your Emergency Fund: Easy Access, Peace of Mind

Your emergency fund should be easily accessible when the need arises. Consider keeping it in a high-yield savings account that offers better interest rates than regular savings accounts, ensuring that your money grows while remaining within reach.

Understanding personal finances may be daunting at first. However, once you get a hang of it, it would bring you closer to your financial goals. Create a better financial future for yourself by equipping yourself with financial knowledge today!

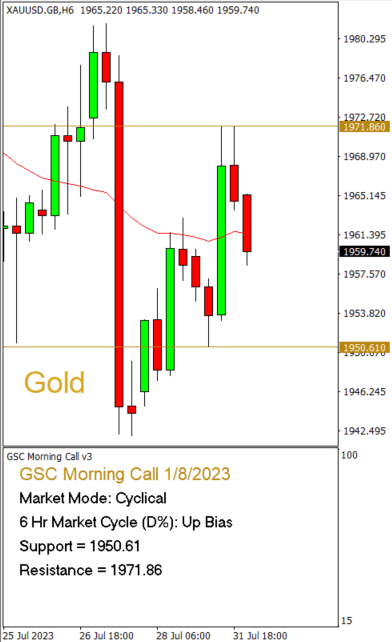

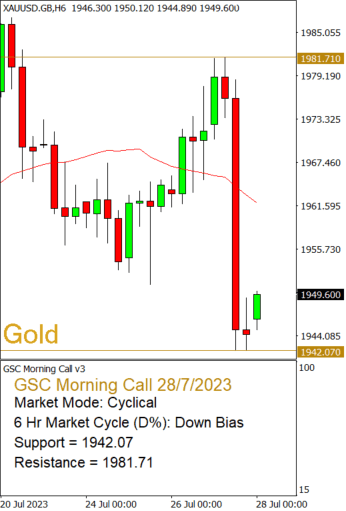

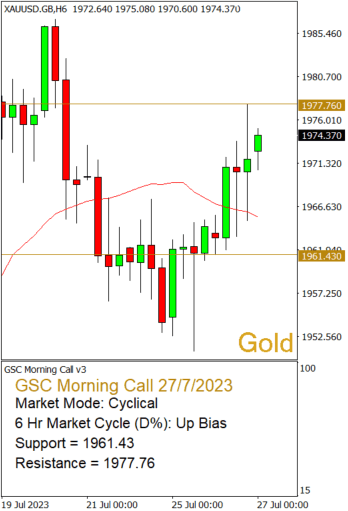

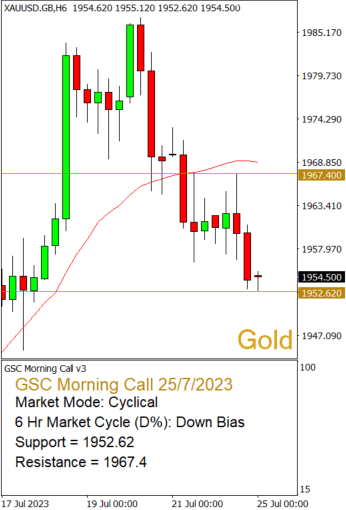

Gold Quarterly Outlook (Q3 2023)

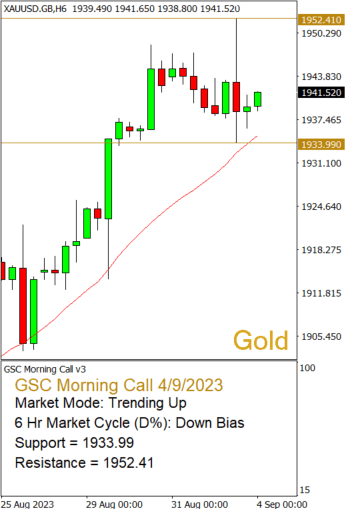

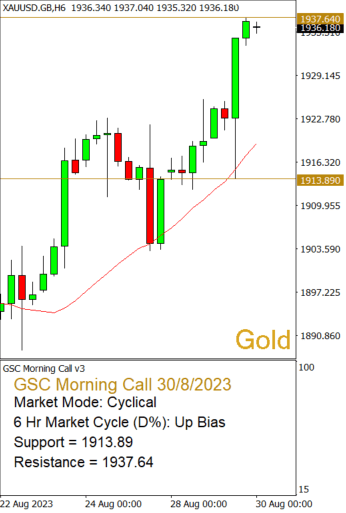

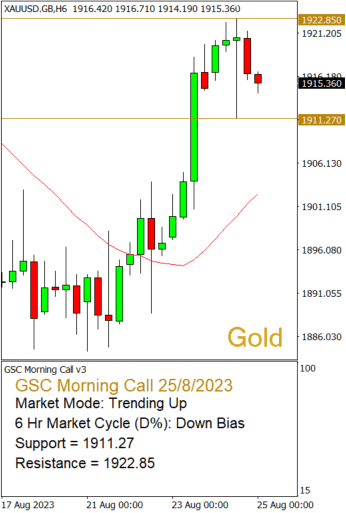

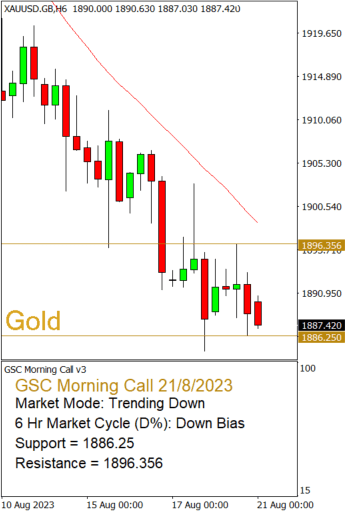

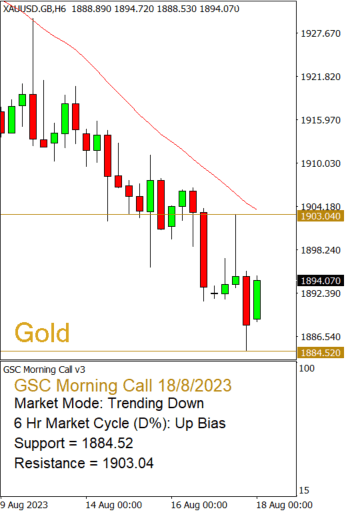

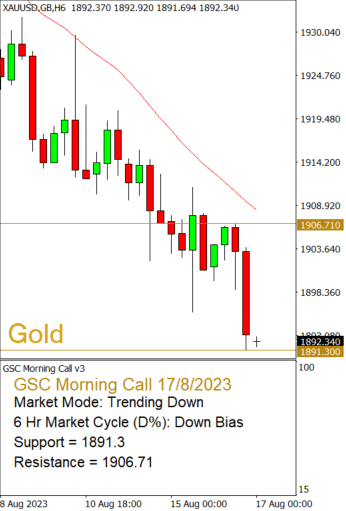

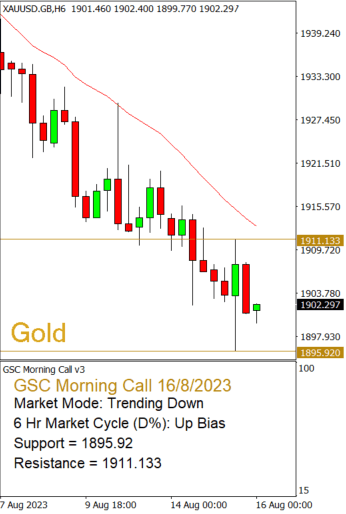

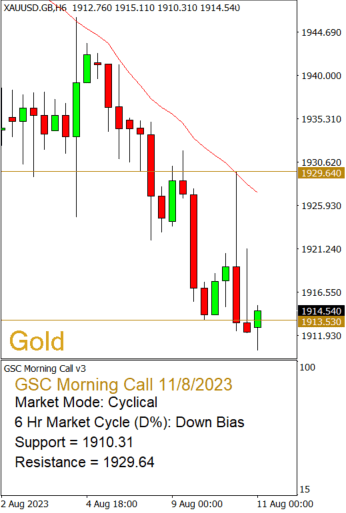

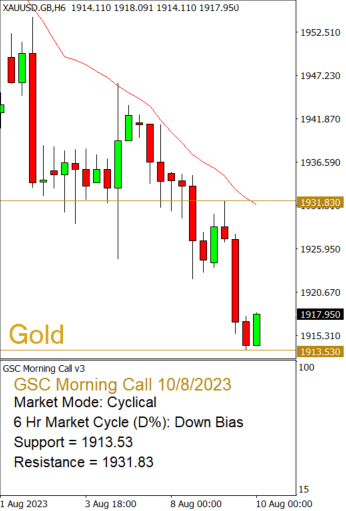

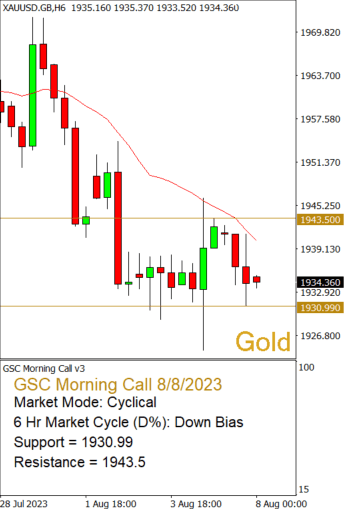

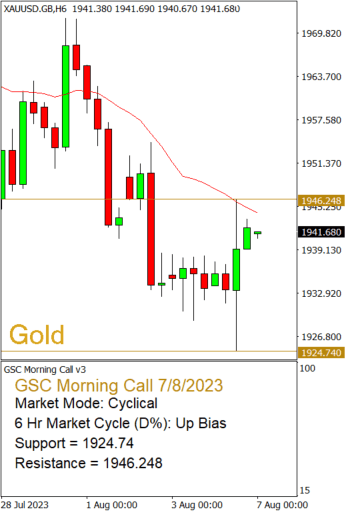

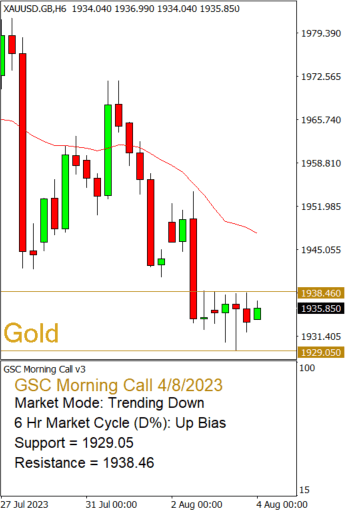

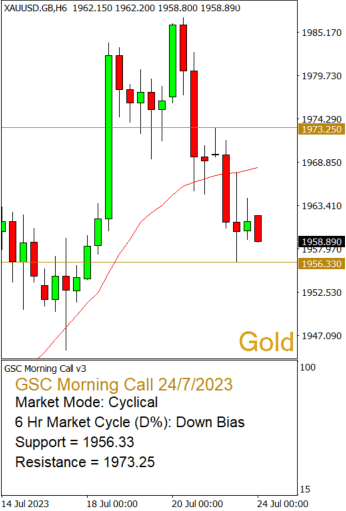

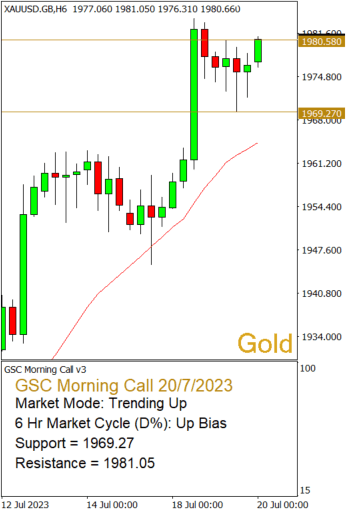

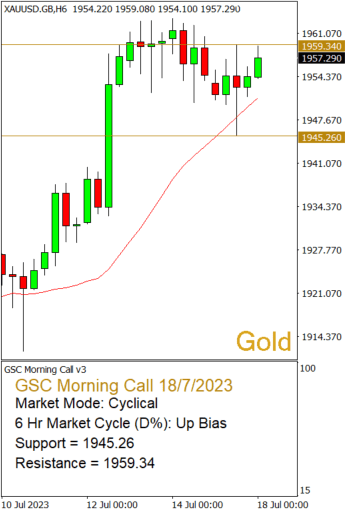

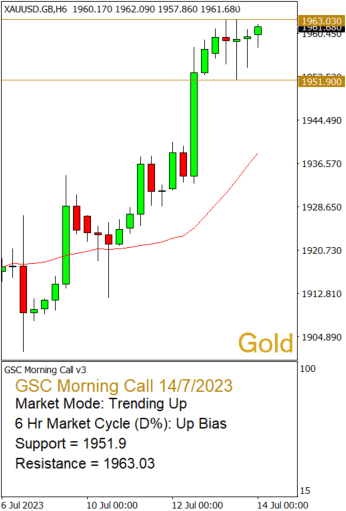

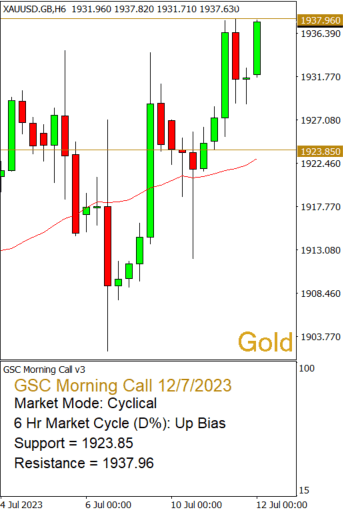

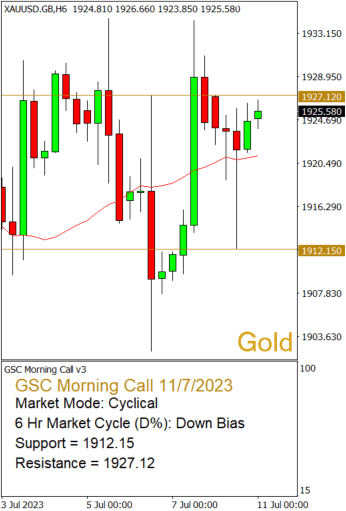

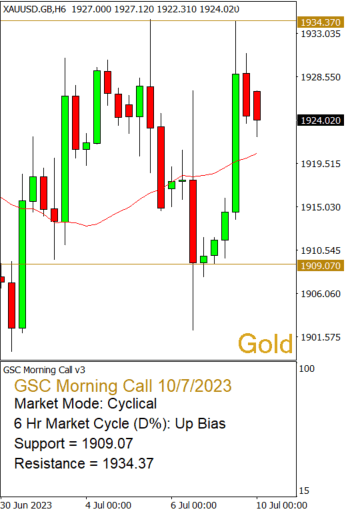

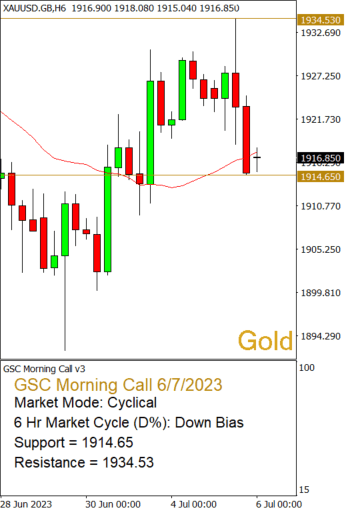

Based on our internal analytic system, there is a good chance of gold price continuing its downtrend for the current quarter (July-Sep 2023). Having said that, the expected drawdown will be rather limited, like what we have seen in Q2 2023 as the selling momentum is still weak at the moment. Gold price is likely to retest last quarter low around 1892USD/oz. A break below 1890USD/oz might open the door towards 1804USD/oz which was the 2023 low. However, chances of hitting 1804USD/oz is still low unless selling momentum picks up over the next 3 months.

Silver Quarterly Outlook (Q3 2023)

Based on our internal analytic system, silver has a relatively similar outlook as Gold. We expect silver to continue its downtrend for another quarter (July-Sep 2023). Silver is likely to revisit Q2 low around 22USD/oz. A break below 22USD/oz might lead Silver to trend lower towards 20USD/oz which was the low for 2023. Again, chance of hitting 20USD/oz is rather slim right now considering the selling momentum is still very weak.

Platinum Quarterly Outlook (Q3 2023)

We also expect Platinum price to fall in the Q3 2023. The selling momentum for Platinum is picking up since the beginning of 2Q 2023. Hence, we might see a bigger drawdown on Platinum. The first important level to watch is 885USD/oz which was the low for 2023. If Platinum breach below 885USD/oz, we might expect the price trending toward 820USD/oz region, which was the 2022 low.

GoldSilver Central offers a wide range of products such as physical precious metals, GSC Savings Accumulation Program and GSC Live! app to help customers to manage their precious metals portfolio effectively. Contact us at +65 6222 9703 or via Whatsapp (+65 88939255) to find out more!

As the holy occasion of Hari Raya Haji, also known as Eid al-Adha or the Festival of Sacrifice, draws near, we joyfully embrace this moment to reflect, connect, and strengthen the bonds of unity. With a deep-rooted history and cherished customs, Hari Raya Haji holds a special place in the hearts of Muslims worldwide. GoldSilver Central extends warm greetings and best wishes to all on this auspicious occasion.

Hari Raya Haji commemorates the profound devotion and unwavering faith of Ibrahim (Abraham), who demonstrated his obedience to God’s command by offering to sacrifice his beloved son, Ismail (Ishmael). In this act of submission, God replaced Ismail with a ram, signifying His acceptance and providing a powerful symbol of sacrifice and faith.

One of the key rituals of Hari Raya Haji is the qurban or udhiya, the act of sacrificing an animal such as a goat, sheep, cow, or camel. This symbolic sacrifice honors Ibrahim’s willingness to make the ultimate sacrifice and serves as a reminder of the values of selflessness, generosity, and sharing. The meat from the sacrificed animal is divided into three portions: one-third for the person making the sacrifice, one-third for family and friends, and one-third for those in need, fostering a sense of compassion and unity within the community.

Hari Raya Haji follows the completion of the Hajj pilgrimage, during which millions of Muslims embark on a spiritual journey to the holy city of Mecca in Saudi Arabia. This pilgrimage is a profound experience of devotion, self-reflection, and unity among the global Muslim community. The celebration of Hari Raya Haji allows Muslims worldwide to join in the spirit of unity and express gratitude for the blessings received.

On the morning of Hari Raya Haji, Muslims gather at mosques or open prayer grounds to perform the special congregational prayer, Salat al-Eid. These prayers, led by an imam, provide an opportunity for Muslims to come together in worship, reflection, and gratitude. The sermon delivered during the prayers emphasizes the significance of sacrifice, faith, and the importance of living righteous lives.

This festive occasion also encourages gatherings with family and friends, where homes are adorned with colorful decorations and delectable traditional dishes are prepared. It is a time for joyful reunions, exchanging greetings, and embracing the spirit of forgiveness and reconciliation. Together, loved ones savor the joyous moments, strengthening familial bonds and fostering a sense of togetherness.

As we celebrate Hari Raya Haji, GoldSilver Central extends heartfelt wishes to our clients, partners, and the wider community. May this joyous occasion bring peace, prosperity, and blessings to all. Let us embrace the values of faith, sacrifice, and unity, and may our collective efforts contribute to a world filled with compassion and harmony.